In today’s rapidly evolving economic landscape, the sharing economy stands out as a beacon of innovation and opportunity. Collaborative consumption, the heart of this economic revolution, has transformed the way we live, work, and interact with one another. This dynamic shift towards sharing assets, services, and experiences has not only reshaped industries but has also created a plethora of investment opportunities waiting to be explored.

Welcome to a world where ownership is no longer the primary goal, and access and collaboration reign supreme. In this guide, we embark on a journey to unveil the top 10 investment opportunities on TacticInvest within the sharing economy. These opportunities are not just investments; they are gateways to a future where sustainable, efficient, and community-driven consumption is the norm.

| Investment Opportunity | Description |

| Peer-to-Peer Lending Platforms | Platforms that facilitate individual lending and borrowing, offering potential interest income. |

| Vacation Rental Platforms | Services like Airbnb that enable property owners to rent their spaces, tapping into the tourism market. |

| Ride-Sharing Services | Companies providing on-demand transportation through mobile apps, reshaping urban mobility. |

| Co-Working Spaces | Shared office spaces catering to remote workers and businesses seeking flexible workspace solutions. |

| Peer-to-Peer Marketplaces | Online platforms connecting individuals for the direct exchange of goods and services. |

| Bike-Sharing and Scooter-Sharing | Sustainable urban mobility solutions through shared bicycles and electric scooters. |

| Storage and Parking Sharing | Platforms offering shared storage and parking solutions to optimize urban space utilization. |

| Tool and Equipment Sharing | Services allowing users to share tools and equipment, reducing the need for ownership. |

| Car-Sharing Services | Companies providing shared access to vehicles, reducing the environmental footprint of personal cars. |

| Food and Meal-Sharing Platforms | Platforms facilitating the sharing of home-cooked meals, promoting community and culinary diversity. |

Peer-to-Peer Lending

In the ever-evolving landscape of modern finance, a silent revolution has been taking shape – Peer-to-Peer (P2P) Lending Platforms. These innovative financial ecosystems usher in a new era of monetary interaction, fostering a symbiotic relationship between lenders and borrowers. Explore this dynamic domain, where the wisdom of crowds and the digital age converge to create a financial tapestry unlike any other.

The Paradigm Shift: Beyond Conventional Banking

Traditional financial institutions have long held sway in the realm of lending and borrowing. Yet, P2P lending platforms have disrupted this age-old hierarchy. Here’s a glimpse of the transformation underway:

- Direct Capital Flows: Bid farewell to intermediaries and red tape. P2P lending platforms facilitate direct connections between those in need of funds and those with the means to provide them.

- Democratizing Finance: The P2P lending revolution dismantles the walls that have traditionally excluded certain individuals from accessing capital. Now, borrowers from various backgrounds can seek funds directly from willing lenders.

- Risk Mitigation Strategies: Advanced algorithms and diversified portfolios reduce the risks associated with lending. Lenders can spread their investments across multiple borrowers, mitigating potential losses.

Investing with a Purpose: Lenders’ Perspective

Delve into the world of P2P lending from an investor’s standpoint, where every financial contribution becomes a strategic move:

- Diversification Opportunities: P2P lending platforms open the door to a multitude of lending opportunities. Investors can diversify their portfolios across a range of borrowers and industries, minimizing exposure to risk.

- Steady Income Streams: The allure of consistent returns beckons. Lenders can earn regular interest payments as borrowers repay their loans, creating a reliable income source.

- Active or Passive Engagement: Choose your level of involvement. Some investors actively select borrowers, while others opt for automated investment options, allowing their money to work for them.

The Borrowers’ Oasis: Accessibility and Convenience

For those seeking financial support, P2P lending platforms offer a lifeline to their dreams:

- Faster Access to Funds: Say goodbye to the arduous processes of traditional banks. P2P lending platforms often provide quicker approval and funding, enabling borrowers to seize opportunities swiftly.

- Competitive Rates: Borrowers can explore diverse interest rate options based on their creditworthiness and the lenders’ terms, potentially securing more favorable terms than traditional loans.

- Transparent Transactions: Complete transparency reigns supreme. Borrowers are informed of all associated fees and interest rates upfront, eliminating hidden surprises.

Embracing the Future of Finance

In the age of digital disruption, P2P lending platforms represent a financial frontier where borrowers and lenders converge, leaving behind the cumbersome shackles of conventional banking. This burgeoning sector offers a world of opportunity for investors, providing steady income streams and diversification benefits. For borrowers, it’s an accessible, transparent, and efficient path to securing the funds needed to turn dreams into reality. In the realm of finance, P2P lending platforms are carving out a unique space where the power of collaboration reigns supreme.

Ride-Sharing Services

In the dynamic arena of modern mobility, a profound transformation has unfurled. Ride-sharing services, those heralds of change, have redefined the contours of urban transportation. For the astute investor, these ventures present an enticing avenue for financial growth. Dive into this realm of innovation where established titans and emerging disruptors are reshaping the way we move.

Beyond Conventional Commutes: The Rise of Ride-Sharing

- Urban Mobility Redefined: Ride-sharing services have rendered traditional transportation modes outdated. The convenience of hailing a ride with a few taps on a mobile app has become the new norm.

- Democratizing Travel: These platforms have democratized travel, making it accessible to diverse demographics. Commuters, tourists, and even those without personal vehicles have all benefited.

Investment Vistas: A Glimpse into Lucrative Prospects

- Established Titans: Investing in established ride-sharing giants can provide stability and the promise of solid returns. Companies with a global presence offer diversified portfolios for discerning investors.

- Emerging Markets: The untapped potential of emerging ride-sharing markets beckons. In regions where ride-sharing is in its infancy, early investors stand to reap substantial rewards.

- Electric Revolution: Keep an eye on the electric revolution. Companies transitioning to electric and autonomous vehicles are poised to shape the future of ride-sharing and offer unique investment prospects.

Risk and Reward: A Delicate Balance

- Regulatory Challenges: Ride-sharing ventures are not without hurdles. Regulatory changes and legal complexities can impact operations. A keen understanding of the regulatory landscape is essential.

- Competitive Landscape: The ride-sharing arena is fiercely competitive. Investors should evaluate a company’s market position, technology stack, and differentiation strategies.

- Consumer Trends: Consumer preferences and trends evolve rapidly. Staying attuned to shifting demand patterns and emerging technologies is paramount for long-term success.

The Road Ahead: Profits and Possibilities

In the grand theater of modern transportation, ride-sharing services have emerged as protagonists of change. They’ve ushered in a new era where convenience and efficiency reign supreme. For investors, these ventures offer a gateway to financial growth, with established market leaders and nascent entrants alike. While risks exist, astute investors with an eye on emerging markets and technological shifts can ride the wave of ride-sharing’s continued evolution. It’s not merely an investment; it’s a journey into the future of transportation.

Vacation Rental Platforms

In the realm of travel and hospitality, a paradigm shift has unfurled. Vacation rental platforms, exemplified by industry disruptor Airbnb, have unveiled new horizons in accommodation. For savvy investors, this burgeoning sector offers an avenue to harness the escalating appetite for unique lodgings. Dive into the world of vacation rental platforms, where innovation meets investment.

A Hospitable Disruption: Redefining the Stay Experience

- Escape the Mundane: Vacation rental platforms are catalyzing a shift from conventional hotels to distinctive, immersive spaces. Ditch the cookie-cutter accommodations; embrace the eclectic.

- Local Living: Travelers yearn for authenticity. Vacation rentals immerse them in local culture, fostering an unparalleled connection to the destination.

Investment Enclaves: Unlocking the Potential

- Market Diversity: Explore a diverse spectrum of investment opportunities within vacation rental platforms. From urban apartments to rustic cabins, options abound.

- Global Footprint: The allure of international investments beckons. Leverage the global reach of platforms like Airbnb to tap into the expanding pool of travelers.

- Tech-Driven Insights: Harness the power of data-driven insights. Platforms provide valuable analytics to inform investment decisions and maximize returns.

Navigating the Landscape: A Balancing Act

- Regulatory Compliance: Be mindful of regulatory nuances. The vacation rental landscape is a patchwork of rules and restrictions. Thoroughly research and adhere to local regulations.

- Maintenance and Management: Consider property management solutions. They can streamline operations, ensuring your investment remains a lucrative asset.

- Guest Experience: Prioritize guest satisfaction. Providing exceptional experiences can garner positive reviews and repeat bookings, boosting your investment’s potential.

The Destination Ahead: Profits and Perspectives

In the grand tableau of travel, vacation rental platforms have assumed center stage, redefining the way we experience new locales. They embody diversity and local immersion, making them the choice of discerning travelers. For investors, this sector offers more than financial returns; it offers the opportunity to curate unique stays for adventurers worldwide. While navigating the landscape may require diligence, the rewards—both financial and experiential—are boundless. It’s not just an investment; it’s an odyssey into the future of hospitality.

Crowdfunding Platforms

In the dynamic realm of financing, a transformative force has emerged—Crowdfunding Platforms. These innovative ecosystems empower individuals to participate in the growth of startups and small enterprises. Offering a kaleidoscope of investment prospects spanning diverse industries, they embody a democratized approach to funding ventures. Journey into the world of crowdfunding, where possibilities bloom without borders.

The Dawn of Crowdfunding: A Revolution in Finance

- Entrepreneurial Empowerment: Crowdfunding platforms usher in a new era of financial autonomy for entrepreneurs. They provide a stage for visionaries to showcase their projects, circumventing traditional funding channels.

- Investment Democracy: Ditch the hierarchies. Crowdfunding invites everyone to the table, democratizing investment opportunities. No longer confined by financial stature, individuals can participate.

Exploring the Investment Universe: A Multifaceted Spectrum

- Startup Sectors: Delve into a treasure trove of sectors. Crowdfunding platforms span industries from technology and healthcare to arts and entertainment, offering a diverse portfolio of investment possibilities.

- Seed, Equity, and Rewards: Choose your investment flavor. Crowdfunding platforms present options ranging from early-stage seed funding to equity investments and unique rewards-based backing.

- Global Ventures: Traverse geographical boundaries. Participate in ventures across the globe, diversifying your portfolio with international opportunities.

Navigating the Terrain: Investment Strategy

- Due Diligence: Conduct meticulous research. Scrutinize project details, financial plans, and the team’s competence. Informed investments are the bedrock of success.

- Risk Mitigation: Spread your wings wisely. Diversify your investments across multiple projects to mitigate risk. Prudent allocation safeguards your capital.

- Active Engagement: Foster connections. Engage with project creators, ask questions, and build relationships. Your involvement can contribute to project success.

The Path Forward: A Tapestry of Possibilities

In the symphony of finance, crowdfunding platforms have carved a unique tune. They epitomize a democratized approach to investment, liberating both entrepreneurs and investors from traditional constraints. For those seeking diverse investment prospects across industries and borders, these platforms offer a gateway to a vibrant ecosystem. While diligence remains paramount, the rewards are a tapestry of innovation, creativity, and global growth. It’s not just an investment; it’s a journey into a limitless realm of possibilities.

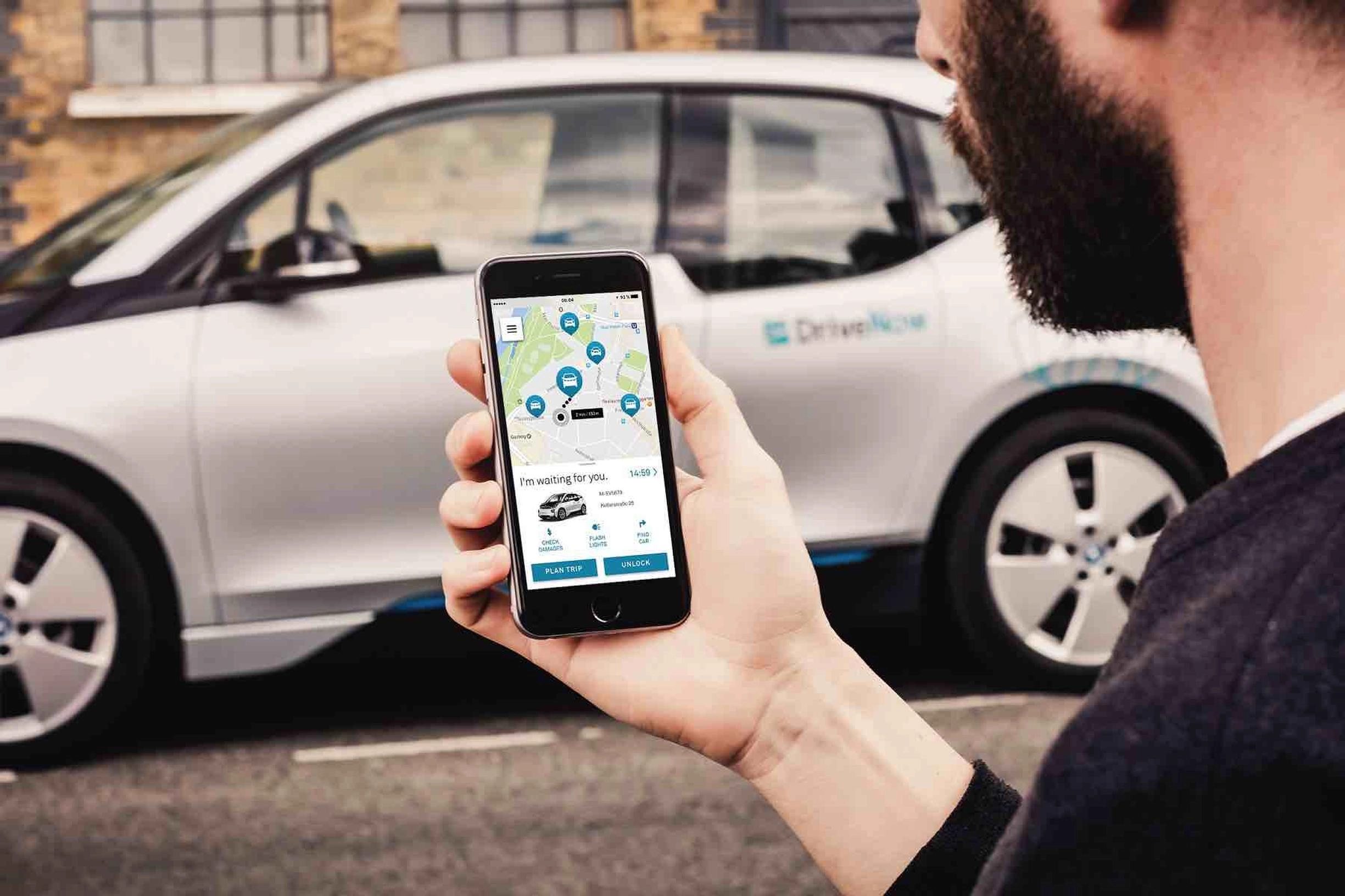

Car-Sharing Services

In the ever-shifting landscape of personal mobility, a profound transformation has taken hold – Car-Sharing Services. These avant-garde enterprises furnish a compelling substitute to customary car ownership. Within this sector lies a vista for astute investors to leverage the burgeoning trend towards communal mobility. Embark on a journey into the world of car-sharing services, where convenience, sustainability, and investment harmonize.

Reinventing the Commute: Car-Sharing’s Rise

- Dissolving Ownership: Car-sharing companies dismantle the notion of personal car ownership. They render the privilege of mobility accessible without the encumbrance of permanent ownership.

- Sustainable Transportation: Eco-consciousness takes the forefront. Car-sharing services promote environmental sustainability by reducing the overall number of vehicles on the road.

Investment Avenues: A Plethora of Prospects

- Market Diversity: Explore a smorgasbord of investment options within the car-sharing milieu. From urban fleets to specialized niche services, a cornucopia of opportunities awaits.

- Global Expansion: The allure of international investments beckons. Invest in companies expanding their footprint across borders, capitalizing on the global demand for shared mobility.

- Technological Advancements: Stay attuned to technological shifts. Companies incorporating electric and autonomous vehicles into their fleets are poised to lead the charge in the future of shared transportation.

Navigating the Landscape: Balancing Risks and Rewards

- Regulatory Vigilance: Navigate the labyrinth of regulations. The car-sharing arena is subject to diverse legal frameworks. A comprehensive understanding is essential to ensure compliance.

- Competition Awareness: Assess the competitive arena. Evaluate the market positioning, technological prowess, and innovation strategies of car-sharing providers for prudent investment decisions.

- User Experience: Prioritize user satisfaction. An exceptional user experience, efficient booking systems, and responsive customer service can significantly enhance the profitability of your investment.

The Journey Ahead: Beyond Investment

In the grand theater of modern mobility, car-sharing services have emerged as the protagonists of change, forging a path towards shared transportation. They offer not merely financial returns, but an opportunity to participate in a transformative movement. While navigating the landscape may require diligence and foresight, the rewards are a tapestry of convenience, sustainability, and investment potential. It’s not just an investment; it’s a voyage into the future of mobility.

Co-Working Spaces

In the contemporary landscape of labor, a seismic shift has taken hold – Co-Working Spaces. These innovative domains, sought after by an ever-increasing cohort of remote workers, offer a dynamic alternative to traditional office environments. For discerning investors, this sector represents an auspicious prospect for long-term financial growth. Step into the realm of co-working spaces, where flexibility, community, and investment intertwine.

The Evolution of Workspaces: A Paradigm Shift

- Remote Work Revolution: Co-working spaces emerge as the epicenter of the remote work revolution, catering to the nomadic workforce of today. They provide the quintessential blend of flexibility and professionalism.

- Community Synergy: Beyond the tangible workspace, co-working environments nurture a sense of community. They facilitate collaboration, networking, and the exchange of ideas among diverse professionals.

Investment Horizons: A Palette of Possibilities

- Diverse Business Models: Explore a mosaic of investment avenues within the co-working ecosystem. From established chains to niche providers focusing on specific industries, the spectrum is vast.

- Global Expansion: Venture into the international stage. Invest in co-working providers with aspirations of expanding their footprint across borders, capitalizing on the burgeoning demand for flexible workspaces worldwide.

- Tech Integration: Embrace the digital age. Companies that integrate advanced technologies for booking, space management, and member engagement are well-positioned for future success.

Navigating the Terrain: Investment Strategy

- Market Research: Rigorous market analysis is paramount. Evaluate the demand for co-working spaces in specific locations, assess competition, and identify trends that influence your investment decisions.

- Quality Infrastructure: Assess the quality of infrastructure and amenities offered by co-working providers. Premium services, ergonomic designs, and robust connectivity can attract and retain members, bolstering your investment returns.

- Membership Models: Understand the membership dynamics. Evaluate pricing strategies, membership types, and the scalability of the co-working provider’s business model.

The Path Forward: Beyond Investment

In the grand tapestry of modern work dynamics, co-working spaces have emerged as crucibles of innovation, offering an amalgamation of flexibility and collaboration. They not only represent an avenue for financial returns but also an opportunity to participate in the reconfiguration of the workplace. While navigating the landscape demands diligence and insight, the rewards extend beyond monetary gains, encompassing the evolution of how we work and connect. It’s not merely an investment; it’s an expedition into the future of workspaces.

Peer-to-Peer Marketplaces Platforms

In the contemporary realm of commerce, a transformative force has gained ascendancy – Peer-to-Peer Marketplaces. These innovative platforms, catalyzing the direct exchange of goods and services between individuals, have established a robust foothold in the marketplace. For savvy investors, this sector presents a tableau of investment potential. Step into the world of peer-to-peer marketplaces, where decentralization, diversity, and investment harmonize.

Democratizing Trade: The Rise of Peer-to-Peer Marketplaces

- Disrupting the Status Quo: Peer-to-peer marketplaces shatter the traditional retail paradigm. They empower individuals to engage in trade, enabling the emergence of micro-entrepreneurs and niche markets.

- Bespoke Commerce: These platforms facilitate bespoke commerce, where buyers and sellers interact directly, fostering a personalized and often artisanal shopping experience.

Investment Avenues: An Array of Opportunities

- Marketplace Diversity: Explore a rich tapestry of investment prospects within the peer-to-peer marketplace realm. From e-commerce titans to specialized platforms catering to unique niches, the spectrum is diverse.

- Global Reach: The allure of international investments beckons. Invest in platforms with global ambitions, capitalizing on the expanding scope of peer-to-peer trade across borders.

- Blockchain Integration: Embrace the decentralized future. Platforms that integrate blockchain technology for secure transactions and trust-building are poised to lead the next wave of peer-to-peer commerce.

Navigating the Landscape: Strategic Considerations

- Market Analysis: Thorough market analysis is essential. Assess the demand for specific goods or services, the competitive landscape, and emerging trends that inform your investment choices.

- Trust and Reputation Systems: Evaluate the trust and reputation systems in place on peer-to-peer platforms. Robust systems inspire confidence among users, fostering a vibrant ecosystem and potential for investment returns.

- User-Centric Design: Prioritize user experience. Platforms that offer intuitive interfaces, responsive customer support, and seamless transactions are more likely to attract and retain users, augmenting investment potential.

The Path Forward: Beyond Investment

In the grand symphony of modern commerce, peer-to-peer marketplaces have risen as catalysts of change, redefining the dynamics of trade. They offer not just financial returns, but an opportunity to participate in the democratization of commerce and the empowerment of individual entrepreneurs. While navigating the landscape demands astute insight, the rewards extend beyond monetary gains, encapsulating the evolution of how we buy and sell in an interconnected world. It’s not simply an investment; it’s a journey into the future of decentralized commerce.

Bike-Sharing and Scooter-Sharing Urban

In the bustling urban milieu, a sustainable mobility renaissance has taken root – Bike-Sharing and Scooter-Sharing Services. These innovative urban travel solutions are surging in popularity, heralding a paradigm shift in transportation. For astute investors, this sector unveils a plethora of opportunities to ride the wave of sustainable urban mobility. Explore the world of bike-sharing and scooter-sharing, where eco-consciousness, convenience, and investment intersect.

Redesigning Urban Transport: The Emergence of Shared Mobility

- Eco-Conscious Commuting: Bike-sharing and scooter-sharing services champion eco-friendly travel alternatives. They enable commuters to embrace sustainable modes of transportation, reducing their carbon footprint.

- Last-Mile Connectivity: These services bridge the last-mile gap in urban transit. They offer a convenient solution for commuters to navigate the final leg of their journey efficiently.

Investment Horizons: A Landscape of Possibilities

- Diverse Mobility Models: Explore an array of investment prospects within the bike-sharing and scooter-sharing domain. From established urban fleets to specialized electric scooter providers, opportunities are multifaceted.

- Global Expansion: Embark on a global investment journey. Invest in companies eyeing international expansion, capitalizing on the burgeoning demand for sustainable urban mobility worldwide.

- Smart Mobility Integration: Embrace the smart mobility revolution. Companies integrating IoT technology and mobile apps to enhance user experience and fleet management are poised for future success.

Navigating the Path: Investment Strategy

- Market Research: Rigorous market analysis is paramount. Assess the demand for shared mobility solutions in specific urban landscapes, evaluate competition, and identify regulatory considerations.

- Infrastructure Quality: Scrutinize the quality of infrastructure and maintenance offered by mobility providers. High-quality, well-maintained vehicles and docking stations can enhance user satisfaction, elevating the potential for investment returns.

- Sustainability Initiatives: Prioritize sustainability practices. Companies with sustainability initiatives, such as renewable energy charging stations and eco-conscious fleet management, align with the growing trend towards green urban mobility.

The Road Ahead: Beyond Investment

In the dynamic tapestry of urban mobility, bike-sharing and scooter-sharing services have emerged as vanguards of change, offering a fusion of sustainability and convenience. They represent not just an avenue for financial returns, but an opportunity to participate in the transformation of how people move within cities. While navigating this landscape necessitates vigilance and foresight, the rewards extend beyond monetary gains, encompassing the evolution of urban travel toward a sustainable future. It’s not just an investment; it’s a journey into the forefront of sustainable urban mobility.

Storage and Parking Sharing Companies

In the urban expanse, where spatial constraints loom large, a transformative solution has emerged – Storage and Parking Sharing Services. These pioneering platforms offer a panacea for the perennial challenge of space scarcity. For discerning investors, this sector unveils a treasury of opportunities to capitalize on the growing demand for innovative spatial solutions. Journey into the world of storage and parking sharing, where ingenuity, convenience, and investment converge.

Unlocking Urban Space: The Ascendance of Shared Storage and Parking

- Urban Spatial Dilemmas: The urban landscape grapples with a shortage of storage and parking facilities. Shared solutions address this challenge, optimizing space utilization and alleviating congestion.

- Dynamic Space Allocation: These services facilitate dynamic space allocation, enabling users to access storage or parking precisely when needed, thus minimizing waste and inefficiency.

Investment Avenues: A Plethora of Opportunities

- Diverse Service Models: Explore a myriad of investment prospects within the storage and parking sharing domain. From shared storage lockers to innovative automated parking systems, the spectrum is diverse.

- Urban Expansion: Venture into urban growth centers. Invest in companies eyeing expansion in densely populated urban areas, where the demand for storage and parking solutions is most pronounced.

- Tech-Driven Innovations: Embrace technology-driven innovations. Companies employing IoT sensors, smart booking apps, and automation in their services are poised for future success.

Navigating the Terrain: Investment Strategy

- Market Analysis: Rigorous market analysis is pivotal. Evaluate the demand for storage and parking solutions in specific urban locales, assess the competitive landscape, and stay abreast of evolving urban planning regulations.

- Infrastructure Excellence: Scrutinize the quality of infrastructure offered by storage and parking providers. State-of-the-art facilities, robust security systems, and user-friendly interfaces enhance user satisfaction, augmenting the potential for investment returns.

- Sustainability Initiatives: Prioritize sustainability practices. Companies adopting eco-friendly construction, renewable energy sources, and green space management align with the growing trend toward sustainable urban solutions.

The Path Forward: Beyond Investment

In the intricate mosaic of urban living, storage and parking sharing services have emerged as trailblazers, offering a harmonious blend of convenience and space optimization. They represent not merely an avenue for financial returns but an opportunity to participate in the evolution of urban spatial management. While navigating this landscape demands vigilance and foresight, the rewards extend beyond monetary gains, encompassing the transformation of urban living into a more efficient, sustainable, and harmonious experience. It’s not merely an investment; it’s a journey into the forefront of urban spatial innovation.

Tool and Equipment Sharing Tool

In the dynamic realm of craftsmanship and construction, a transformative solution has emerged – Tool and Equipment Sharing Platforms. These innovative ecosystems cater to the needs of do-it-yourself enthusiasts and seasoned professionals alike, providing an avenue for cost-effective access to an arsenal of tools. For discerning investors, this sector unfolds a treasury of opportunities to tap into the burgeoning demand for tool-sharing services. Embark on a journey into the world of tool and equipment sharing, where resourcefulness, efficiency, and investment intersect.

Revolutionizing Access to Tools: The Ascendance of Sharing Platforms

- Access Over Ownership: The tool and equipment sharing paradigm champions access over ownership, revolutionizing how individuals and professionals procure tools for their projects.

- Cost-Efficient Endeavors: These platforms enable users to embark on projects without the financial burden of purchasing costly tools, promoting fiscal prudence and cost-effective ventures.

Investment Avenues: A Multifarious Array

- Diverse Tool Repertoire: Explore a diverse tapestry of investment prospects within the tool and equipment sharing domain. From woodworking tools to specialized construction equipment, the spectrum is vast.

- Global Penetration: Venture into growth markets. Invest in platforms with plans for international expansion, capitalizing on the escalating demand for accessible tools worldwide.

- Tech-Driven Solutions: Embrace technology-driven innovations. Companies incorporating digital booking systems, inventory management, and tool tracking solutions are poised for future success.

Navigating the Landscape: Investment Strategy

- Market Insight: Thorough market analysis is pivotal. Assess the demand for tool and equipment sharing services in specific regions, evaluate competition, and stay attuned to evolving construction regulations.

- Quality Assurance: Scrutinize the quality of tools and equipment offered by sharing platforms. Ensuring well-maintained, high-caliber tools enhances user satisfaction, elevating the potential for investment returns.

- User-Centric Experience: Prioritize the user experience. Platforms offering intuitive interfaces, responsive customer support, and streamlined tool pickup and return processes are more likely to attract and retain users, augmenting investment potential.

The Path Forward: Beyond Investment

In the intricate fabric of construction and craftsmanship, tool and equipment sharing platforms have emerged as champions, offering a harmonious blend of resourcefulness and cost-efficiency. They represent not merely an avenue for financial returns but an opportunity to participate in the transformation of how tools are accessed and utilized. While navigating this landscape necessitates vigilance and foresight, the rewards extend beyond monetary gains, encapsulating the empowerment of builders and creators worldwide. It’s not just an investment; it’s a journey into the forefront of collaborative tool sharing.