Welcome to TacticInvest, where we navigate the intricate landscape of investment opportunities with precision and foresight. In this exclusive exploration, we delve into the pulsating realm of the automotive industry, unraveling the top 10 investment prospects that promise to shape the future of mobility. As the global automotive landscape undergoes unprecedented transformations, strategic investors can position themselves at the nexus of innovation and profitability. Join us on this journey as we unveil the keys to unlocking sustainable returns in a world where the wheels of change are in perpetual motion. It’s time to harness the power of foresight and capitalize on the dynamic evolution of the automotive sector.

| Investment Area | Key Highlights |

| Electric Vehicles (EVs) and Battery Technology | Growing demand for sustainable transportation, government incentives, and advancements in battery efficiency create opportunities for manufacturers and infrastructure developers. |

| Autonomous Vehicles | The transformative trend of self-driving cars presents investment prospects in sensor technologies, software development, and collaborations within the autonomous driving ecosystem. |

| Advanced Driver Assistance Systems (ADAS) | Rising demand for safety features in vehicles fuels the market for ADAS technologies, creating opportunities for companies specializing in components and systems enhancing vehicle safety. |

| Connected Car Technologies | Integration of internet connectivity in cars opens avenues for data-driven services. Investing in connected car platforms, telematics, and in-car entertainment systems aligns with this evolving landscape. |

| Alternative Fuels | As the industry shifts towards sustainability, investments in companies developing hydrogen and biofuel technologies offer strategic opportunities in the quest for greener transportation. |

| E-Mobility Infrastructure (Charging Networks) | Supporting the electric vehicle ecosystem requires robust charging infrastructure. Investment in companies involved in building and expanding charging networks is essential for future mobility. |

| Smart Manufacturing (Industry 4.0) | Companies implementing Industry 4.0 technologies, including automation, AI, and IoT, are reshaping automotive manufacturing. Investing in these advancements aligns with the evolution of smart factories. |

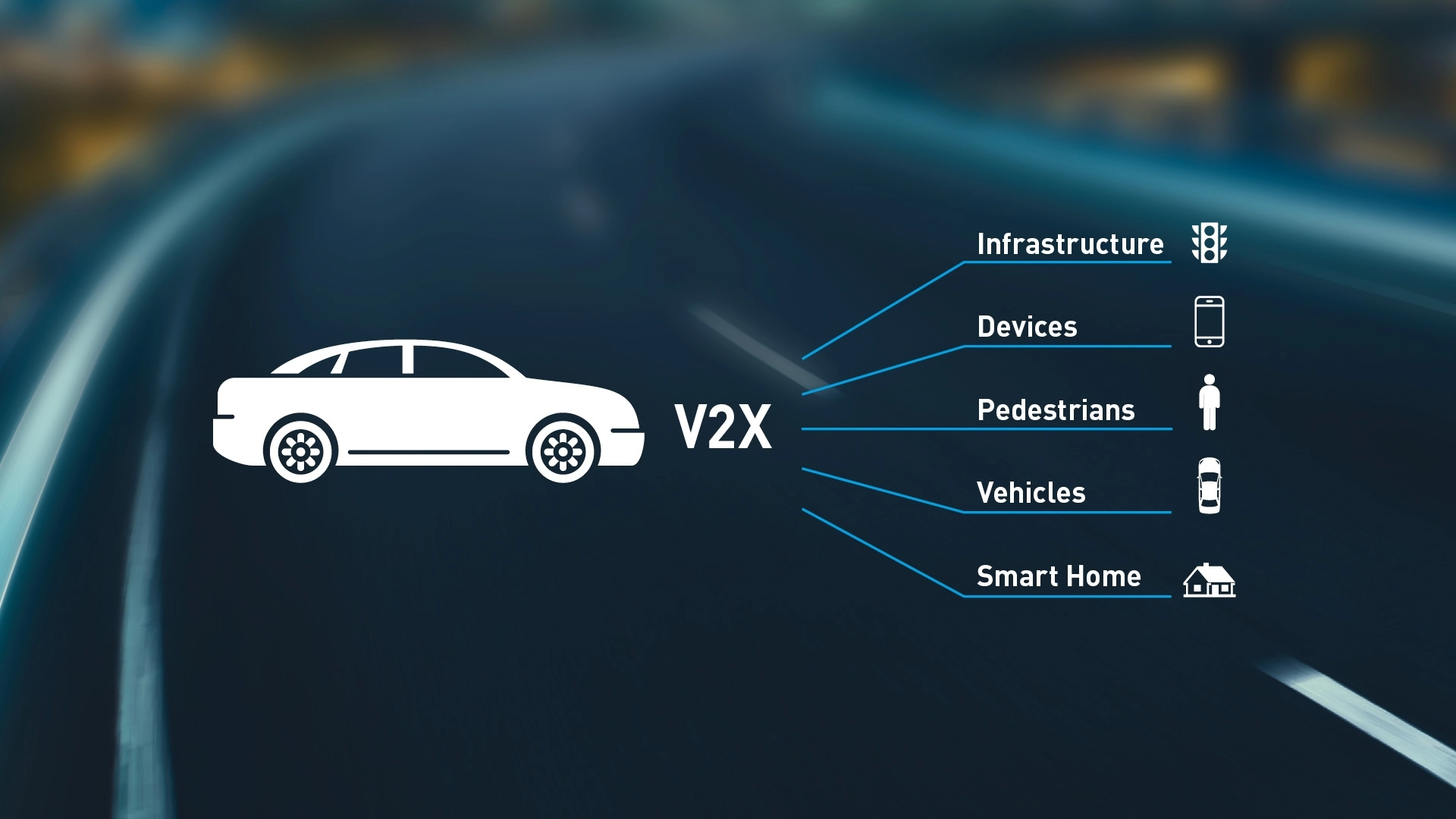

| Vehicle-to-Everything (V2X) Communication | Enabling vehicles to communicate with each other and surrounding infrastructure enhances safety and efficiency. Investments in V2X communication technologies capitalize on smart transportation. |

| Recycling and Sustainability | Focus on environmental responsibility opens investment opportunities in automotive recycling, sustainable materials, and eco-friendly manufacturing processes. |

| Supply Chain Optimization | Enhancing efficiency in the automotive supply chain is crucial. Investments in companies offering innovative solutions for supply chain management, logistics, and procurement present strategic opportunities. |

Electric Vehicles (EVs)

In the relentless pursuit of sustainable transportation, the automotive industry is undergoing a seismic shift, and at the helm of this green revolution are Electric Vehicles (EVs). As the world sets its sights on a cleaner, more eco-friendly future, investors are increasingly turning their attention to the buzzing realm of EVs. This isn’t just a trend; it’s a transformation, and savvy investors are recognizing the potential goldmine that lies within the EV landscape. In this electrifying journey, we explore the top-tier investment opportunities within the EV sector, where the road to profitability is paved with innovation, green technology, and a commitment to a cleaner planet.

The Rise of EVs:

Electric vehicles have transcended the niche market and are now cruising into the mainstream. The environmental consciousness coupled with advancements in battery technology has positioned EVs as the poster child for sustainable transportation. The automotive landscape is no longer just about horsepower and torque; it’s about reducing carbon footprints and embracing a future where mobility aligns seamlessly with environmental responsibility.

Investment Oasis: EV Manufacturing

To ride the wave of EV prominence, one must first explore the heart of the industry – EV manufacturing. Companies at the forefront of producing cutting-edge electric vehicles are not just assembling cars; they are crafting the future of transportation. Investing in these trailblazers means being part of a movement that goes beyond profit margins; it’s about contributing to a paradigm shift in how the world commutes.

Powering the Future: Battery Technology

Batteries are the lifeblood of EVs, and the companies driving battery technology innovations are at the core of the industry’s electrifying evolution. Whether it’s advancements in energy density, charging speed, or overall efficiency, investing in battery technology pioneers is like holding the key to the next chapter in automotive history. The race for superior battery tech is not just a competition; it’s a marathon towards a sustainable future.

Charging Ahead: Infrastructure Investments

As EV adoption accelerates, the need for a robust charging infrastructure becomes paramount. Investing in companies dedicated to shaping the charging landscape ensures a stake in the foundation of the EV revolution. Charging stations are the pit stops of the future, and those investing wisely in this critical aspect are laying the groundwork for a seamlessly connected, electrified world.

The road ahead is unmistakably electric, and within the realm of Electric Vehicles, investors find not just a financial opportunity but a chance to contribute to a more sustainable tomorrow. From manufacturing pioneers to battery trailblazers and infrastructure visionaries, the EV sector beckons with promise. As the automotive industry reshapes itself, those who embrace the electric future stand poised to reap the rewards of a transformative era. It’s not just about investing in companies; it’s about investing in a greener, more sustainable future for all.

Autonomous Vehicles

The development of self-driving cars has transcended the realm of science fiction, ushering in a new era where the steering wheel takes a backseat, and technology takes the wheel. This paradigm shift is not just a trend; it’s a transformative force, and astute investors are recognizing the thrilling investment prospects that lie within the autonomous vehicle technology sector. In this journey through the autonomous lanes of the future, we explore the captivating opportunities presented by companies spearheading the revolution in sensor technology, software development, and the captivating world of self-driving cars.

The Autonomy Revolution

The dream of cars navigating the roads sans human intervention is no longer confined to futuristic visions; it’s a reality unfolding before our eyes. The autonomy revolution is reshaping the way we perceive transportation, offering not just convenience but a leap into a safer, more efficient era of mobility. The allure of autonomous vehicles isn’t just about convenience; it’s about rewriting the rules of the road and, by extension, rewriting the future of transportation.

Investment Vistas: Sensor Manufacturers

At the heart of the autonomous vehicle revolution are the unsung heroes – the sensor manufacturers. Companies pioneering sensor technologies that enable cars to perceive and interpret their surroundings are the architects of this transformative trend. Investing in these innovators means holding the key to the eyes and ears of self-driving cars. From LiDAR to radar, the race to enhance sensor capabilities is not just a technological pursuit; it’s a race towards making autonomous vehicles not just smart but brilliant.

Driving into the Future: Software Developers

The brain behind the brawn of autonomous vehicles lies in the intricate web of software that orchestrates their every move. Companies at the forefront of software development for autonomous driving are not merely coding lines; they are scripting the future of mobility. Investing in these digital maestros means being part of a symphony where algorithms replace engine roars, and lines of code map out the roads of tomorrow. The software that powers self-driving cars isn’t just intelligent; it’s the conductor of an automotive revolution.

Beyond the Horizon: Exciting Prospects

As we gaze beyond the horizon of autonomous vehicles, the investment prospects become even more exciting. The ripple effects extend beyond the obvious players to include companies working on infrastructure, cybersecurity, and regulatory solutions. The autonomous landscape is a multifaceted tapestry, and those who can discern the interconnected threads stand to gain from the broader canvas of opportunities.

The road to autonomy is not just a path paved with technology; it’s a transformative journey redefining the very essence of transportation. Investing in the autonomous vehicle sector isn’t just about backing companies; it’s about investing in the architects of a future where cars navigate with an intelligence that surpasses human limitations. As the autonomous revolution accelerates, those who embark on this investment journey find themselves not just witnessing history but actively shaping the contours of the roads that lie ahead. The future is autonomous, and within it, lies a world of thrilling investment possibilities.

Advanced Driver Assistance Systems (ADAS)

ADAS technologies have transcended from luxury features to becoming integral components of modern vehicles, ushering in an era where cars are not just modes of transportation but intelligent guardians on the road. Investors with a keen eye for burgeoning trends recognize the lucrative potential within the realm of ADAS, where companies specializing in components and systems stand at the forefront of a rising demand for enhanced automotive safety. This exploration navigates the terrain of ADAS, revealing the exciting investment prospects that lie within the heart of vehicular safety innovation.

The Safety Renaissance

ADAS isn’t merely a collection of features; it’s a safety renaissance in the automotive world. From collision avoidance and lane-keeping assistance to adaptive cruise control, these systems collectively create a cocoon of safety around the driver and passengers. The goal is not just to make driving more convenient but to fundamentally redefine safety standards, making roads safer for everyone.

Investment Thrust: ADAS Component Manufacturers

At the core of the ADAS revolution are the companies engineering the very components that breathe life into these safety features. Investing in ADAS component manufacturers means tapping into the nerve center of safety innovation. Whether it’s sensors, cameras, or radar systems, these components are the building blocks of a safer driving future. Companies pushing the boundaries of component technology aren’t just suppliers; they are architects constructing a safety infrastructure for the roads of tomorrow.

Systematic Investment: ADAS Solution Providers

While individual components form the backbone, it’s the integration and synergy of these elements that truly elevate ADAS to its full potential. Investing in companies specializing in comprehensive ADAS systems ensures a holistic approach to vehicular safety. These solution providers are the conductors orchestrating a symphony of safety features, seamlessly integrating components to create a cohesive and responsive driving experience. As ADAS systems become standard in modern vehicles, the demand for innovative and reliable solutions is on the ascent.

Capitalizing on Rising Demand

The rising demand for ADAS technologies extends beyond individual components and systems. Companies investing in research and development, constantly pushing the boundaries of what ADAS can achieve, are poised to capture the market’s attention. Furthermore, as regulatory bodies worldwide tighten safety standards, the demand for cutting-edge ADAS solutions is set to skyrocket, creating a robust market for investors to explore.

ADAS is not just a technological leap; it’s a commitment to a safer, more secure driving future. Investors navigating the landscape of ADAS components and systems are not merely participating in a market trend; they are contributing to the evolution of automotive safety. As the demand for advanced safety features continues to surge, those who position themselves wisely within the ADAS realm find themselves not just witnessing but actively shaping the future of vehicular safety. In this era of smart driving, the road to investment success is paved with innovation and a steadfast commitment to making every journey a safer one.

Connected Car Technologies

The integration of internet connectivity into vehicles is not just a technological leap; it’s a gateway to a new era where cars are not only modes of transportation but intelligent hubs of connectivity. This shift presents more than just convenience; it unlocks a realm of data-driven services and experiences. For astute investors, this represents a goldmine of opportunities, especially within the domains of connected car platforms, telematics, and in-car entertainment systems. Buckle up as we navigate through the vast landscape of connected cars, unveiling the exciting investment prospects that lie within.

The Connected Horizon

Connected Car Technologies are propelling the automotive industry into uncharted territories. Cars are no longer isolated entities but rather nodes within a vast network, constantly communicating and exchanging information. This interconnectedness gives rise to a plethora of possibilities, from enhanced safety features to personalized in-car experiences, fundamentally transforming the way we perceive and interact with our vehicles.

Investment Avenue: Connected Car Platforms

At the epicenter of this revolution are companies spearheading the development of connected car platforms. Investing in these trailblazers means entering the nucleus of innovation where the digital and automotive worlds converge. These platforms not only facilitate internet connectivity but also lay the foundation for a host of data-driven services, ranging from real-time traffic updates to remote vehicle monitoring. Companies driving the evolution of connected car platforms are architects of a future where vehicles seamlessly integrate with the digital fabric of our lives.

Telematics: The Pulse of Connected Cars

Telematics, the technology combining telecommunications and informatics, forms the beating heart of connected cars. Companies specializing in telematics solutions enable the collection and transmission of crucial vehicle data. This data, ranging from engine diagnostics to driver behavior, not only enhances vehicle performance but also serves as a foundation for innovative services such as usage-based insurance and predictive maintenance. Investors delving into the realm of telematics are not merely investing in technology; they are investing in the pulse that keeps connected cars alive and thriving.

In-Car Entertainment Systems: Beyond the Drive

As connectivity becomes ingrained in the automotive experience, in-car entertainment systems are evolving into sophisticated hubs of multimedia and connectivity. Companies leading the charge in this domain are not just providing infotainment; they are crafting immersive in-car experiences. From streaming services and augmented reality displays to personalized content delivery, the investment potential within in-car entertainment systems is not just rewarding but promises to redefine the very concept of the journey itself.

Connected Car Technologies are not merely transforming the automotive industry; they are reshaping the way we engage with our vehicles. Investors attuned to the possibilities within connected car platforms, telematics, and in-car entertainment systems are not just participating in a market trend; they are driving innovation in an era where the road ahead is as digital as it is paved. As the automotive industry hurtles into a connected future, those who strategically position themselves within this landscape are not just investors; they are architects of the automotive experience of tomorrow. The journey is connected, and within it lies a world of investment opportunities waiting to be explored.

Alternative Fuels

As the world grapples with the urgency of reducing carbon emissions, alternative fuels, including hydrogen and biofuels, have emerged as frontrunners in the race towards cleaner, greener transportation. For investors with an eye on both environmental responsibility and strategic financial gains, delving into companies pioneering these alternative fuel technologies proves to be not just prudent but visionary. This exploration embarks on a journey through the landscape of alternative fuels, uncovering the strategic investment opportunities that lie within the realms of hydrogen and biofuels.

The Green Imperative

The automotive industry’s trajectory towards sustainability is no longer a distant aspiration but a present reality. Alternative fuels, propelled by a commitment to reduce dependence on traditional fossil fuels, are emerging as pivotal players in shaping the industry’s sustainable future. The allure isn’t just about mitigating environmental impact; it’s about redefining the very essence of what propels our vehicles and drives our economies.

Investment Prowess: Hydrogen Technologies

At the forefront of alternative fuels is hydrogen, a clean energy carrier with the potential to revolutionize the transportation landscape. Investing in companies dedicated to the development of hydrogen technologies is a strategic move, positioning oneself in the vanguard of a fuel source that boasts zero emissions and holds the promise of powering everything from cars to heavy-duty trucks. Companies driving advancements in hydrogen production, storage, and distribution are not just forging a path towards a sustainable future; they are charting the course for an energy revolution.

Biofuels: A Sustainable Symphony

Biofuels, derived from organic matter such as crops and waste, offer a sustainable alternative to traditional fossil fuels. Investing in companies committed to the development and promotion of biofuels aligns with the ethos of circular economies and responsible resource utilization. As the demand for renewable energy surges, companies engaged in biofuel technologies are not just providers of fuel; they are stewards of an ecological symphony where waste is transformed into a valuable resource.

Strategic Considerations

The strategic move towards investing in alternative fuels extends beyond the environmental conscience. It encompasses the recognition that sustainable practices are becoming integral to corporate success. Governments globally are incentivizing the shift towards greener technologies, making investments in alternative fuels not just forward-thinking but aligned with evolving regulatory landscapes.

Investing in companies at the forefront of alternative fuels is not just about staying ahead of the curve; it’s about actively participating in the reimagining of the automotive industry. As the tides shift towards sustainability, those who strategically position themselves within the realms of hydrogen and biofuels are not just investors; they are contributors to a greener, more resilient future. The road ahead is fueled by innovation, and within the domain of alternative fuels lies a strategic investment landscape waiting to be explored. It’s not just about driving change; it’s about fueling the future.

E-Mobility Infrastructure

The success of electric vehicles hinges not only on technological advancements but equally on the development of a robust charging infrastructure. Investing in companies dedicated to building and expanding charging networks is not just a financial strategy; it’s a commitment to supporting the very backbone of the electric vehicle ecosystem. This exploration navigates through the charging lanes of E-Mobility Infrastructure, shedding light on why investing in the expansion of charging networks is an essential move as the demand for EVs surges.

The Electric Horizon

Electric vehicles have transcended from niche alternatives to mainstream contenders, and their success is contingent upon an accessible and efficient charging infrastructure. The charging landscape is not just about power outlets; it’s about creating a network that mirrors the ubiquity and convenience of traditional fuel stations. As the demand for EVs continues to soar, investing in the infrastructure that powers them becomes a strategic move with far-reaching implications.

Investment Imperative: Building Charging Networks

At the forefront of E-Mobility Infrastructure investments are companies dedicated to building and expanding charging networks. These entities are not merely laying down charging stations; they are architects of a future where charging is as seamless as the drive itself. Investing in these trailblazers means positioning oneself at the epicenter of the EV revolution. Whether it’s fast-charging stations along highways or strategically placed charging points in urban centers, companies leading the charge in charging network development are not just meeting demand; they are shaping the very contours of the electric mobility landscape.

The Rise of Fast-Charging Networks

The evolution of charging networks isn’t solely about quantity; it’s about speed and accessibility. Fast-charging networks are emerging as game-changers, reducing the traditional barriers associated with EV adoption. Investing in companies pushing the boundaries of fast-charging technologies ensures a stake in a future where range anxiety becomes a relic of the past. These investments aren’t just financial; they are contributions to a future where charging an EV is as convenient as refueling a conventional vehicle.

Strategic Partnerships and Innovations

The success of E-Mobility Infrastructure investments also hinges on strategic partnerships and continuous innovations. Companies collaborating with automakers, energy providers, and technology firms are creating synergies that amplify the impact of charging infrastructure investments. Additionally, innovations such as smart charging solutions and energy storage integration are transforming charging stations into dynamic hubs, paving the way for a more sustainable and interconnected electric future.

Investing in E-Mobility Infrastructure is not just about anticipating market trends; it’s about actively participating in the evolution of transportation. As the demand for electric vehicles accelerates, those who strategically invest in companies building and expanding charging networks are not just stakeholders; they are facilitators of a revolution. The road ahead is electric, and within the realm of E-Mobility Infrastructure lies a strategic investment landscape waiting to be explored. Charging ahead isn’t just about meeting demand; it’s about empowering the future of mobility.

Supply Chain Optimization

In the intricate dance of the automotive industry, where precision and efficiency are paramount, Supply Chain Optimization emerges as a pivotal player. From raw material procurement to the final assembly line, the efficiency of the supply chain is a linchpin in the success of automotive manufacturers. Investing in companies that pioneer innovative solutions for supply chain management, logistics, and procurement isn’t just a strategic move; it’s an acknowledgment of the transformative power these solutions wield in shaping the competitive landscape. This exploration navigates through the complex intersections of automotive supply chain optimization, revealing why investing in the architects of efficiency is a compelling opportunity.

The Supply Chain Symphony

The automotive supply chain is a symphony of intricate processes, where timing, precision, and resource optimization define success. From sourcing raw materials globally to delivering finished products to markets, the efficiency of each link in the supply chain contributes to the overall performance of automotive manufacturers. As the industry evolves, companies that can fine-tune this symphony and drive efficiency become integral players in the pursuit of excellence.

Investment Dynamics: Supply Chain Management Innovators

At the heart of supply chain optimization are companies offering innovative solutions in supply chain management. Investing in these innovators means aligning with entities that go beyond traditional logistics. They leverage technologies like artificial intelligence, data analytics, and IoT to enhance visibility, reduce lead times, and minimize inefficiencies across the entire supply chain. Whether it’s predictive analytics to foresee demand fluctuations or real-time tracking for streamlined logistics, these companies are the architects of a supply chain revolution.

Logistics: The Strategic Chessboard

Efficient logistics isn’t merely about moving goods from point A to point B; it’s a strategic chessboard where each move impacts the entire operation. Companies investing in state-of-the-art logistics solutions are orchestrating a ballet of efficiency, where optimized routes, real-time tracking, and just-in-time deliveries are not luxuries but necessities. Investing in these logistical maestros means positioning oneself in the vanguard of a logistical evolution that isn’t just about transportation but about strategic resource allocation.

Procurement: Strategic Sourcing Redefined

The raw materials that fuel the automotive industry are sourced globally, making procurement a critical aspect of supply chain optimization. Companies transforming procurement into a strategic advantage, leveraging technology for vendor management, cost negotiation, and risk mitigation, offer unique investment prospects. Investing in these procurement pioneers means participating in the evolution of sourcing strategies that go beyond cost reduction, focusing on resilience and sustainability.

Strategic Investments for a Competitive Edge

The automotive industry is not just a race of speed; it’s a race of efficiency. As global markets become more interconnected, those who invest strategically in companies driving supply chain optimization are not just adapting to market trends; they are shaping the competitive landscape. From innovative supply chain management solutions to cutting-edge logistics and strategic procurement, these investments aren’t just financial; they are contributions to a more resilient and agile automotive industry.

Investing in the architects of automotive supply chain optimization isn’t just about finding opportunities; it’s about recognizing the integral role these companies play in defining the future of the industry. As automotive manufacturers seek to navigate a landscape of increasing complexity, those who strategically position themselves within the realms of supply chain efficiency are not just investors; they are catalysts of a revolution that propels the industry towards new heights of excellence. The road to success is paved with efficiency, and within the domain of supply chain optimization lies a strategic investment landscape waiting to be explored.

Smart Manufacturing

Smart Manufacturing, fueled by automation, artificial intelligence (AI), and the Internet of Things (IoT), is no longer a vision of the future; it’s the driving force propelling the industry into a new era of efficiency and innovation. For savvy investors, the potential for significant returns lies in companies at the forefront of implementing these smart manufacturing processes. This exploration navigates through the digital corridors of automotive manufacturing, revealing why investments in automation, AI, and IoT are not just strategic but paramount for those seeking substantial returns.

The Digital Renaissance

Industry 4.0 marks a digital renaissance in manufacturing, transforming traditional production processes into interconnected, intelligent systems. In the automotive sector, where precision and efficiency are paramount, smart manufacturing technologies are heralding a paradigm shift. The marriage of automation, AI, and IoT isn’t just about upgrading machinery; it’s about redefining how vehicles are conceived, designed, and assembled.

Investment Focus: Automation Redefined

At the core of smart manufacturing is automation – the engine driving efficiency and precision on the factory floor. Investing in companies pioneering advanced automation solutions means tapping into the pulse of a revolution where robots and autonomous systems seamlessly collaborate with human workers. From robotic arms assembling components with unparalleled accuracy to autonomous vehicles navigating production lines, automation investments go beyond cost-cutting; they represent a strategic bet on the future of manufacturing agility.

Artificial Intelligence: The Cognitive Factory

Smart manufacturing is not just about machines working harder; it’s about them working smarter. Companies harnessing AI for predictive maintenance, quality control, and process optimization are unlocking the cognitive potential of the factory. Investing in AI-driven manufacturing is an acknowledgment that efficiency isn’t just about speed but about making informed decisions based on real-time data. These investments position oneself at the forefront of a manufacturing revolution where machines don’t just follow instructions; they anticipate needs.

Internet of Things (IoT): Connectivity Redefined

The IoT is the nervous system of smart manufacturing, interconnecting devices, machines, and systems for real-time communication and decision-making. Investing in companies leveraging IoT in manufacturing means participating in a networked ecosystem where every component, from sensors to assembly lines, contributes to a harmonious symphony of efficiency. These investments aren’t just about connectivity; they represent a strategic move towards a more responsive and adaptive manufacturing environment.

Strategic Considerations

Smart manufacturing investments extend beyond the factory floor. Companies embracing digital twins for product development, implementing blockchain for supply chain transparency, and adopting 3D printing for agile prototyping represent additional dimensions of strategic investment opportunities. As the automotive industry embraces the digital age, those who strategically invest in smart manufacturing technologies aren’t just adapting to change; they are shaping the future of production.

Investing in companies driving smart manufacturing processes isn’t just about seeking returns; it’s about recognizing the transformative power these technologies hold in redefining the automotive manufacturing landscape. As Industry 4.0 unfolds, those who strategically position themselves within the realms of automation, AI, and IoT are not just investors; they are architects of a new era in manufacturing excellence. The road to significant returns is paved with digital innovation, and within the domain of smart manufacturing lies a strategic investment landscape waiting to be explored.

Vehicle-to-Everything (V2X) Communication

This transformative technology allows vehicles to communicate not only with each other but also with the surrounding infrastructure, creating a networked ecosystem that goes beyond the conventional confines of the road. For discerning investors, the allure lies in companies spearheading V2X communication technologies, where strategic investments can not only capitalize on the evolution of smart transportation but also redefine the safety and efficiency paradigms on our roads. This exploration embarks on a journey through the interconnected highways of V2X communication, shedding light on why investing in its evolution is not just visionary but imperative.

The V2X Revolution

V2X communication stands as a testament to the intersection of automotive innovation and digital connectivity. It goes beyond the traditional scope of vehicle communication, extending its reach to encompass everything – from interactions between vehicles (V2V) to communications with infrastructure (V2I), pedestrians (V2P), and even other devices (V2D). The result is a dynamic network where vehicles become nodes in a symphony of information exchange, fostering a safer and more efficient driving environment.

Investment Essence: Companies Driving V2X Technologies

At the forefront of the V2X revolution are companies dedicated to advancing communication technologies. Investing in these pioneers means being part of a transformative journey where cars aren’t just modes of transportation but integral components of a connected ecosystem. Companies leading the charge in V2X technologies are developing the communication protocols, sensors, and software solutions that form the backbone of this interconnected network. These investments aren’t just financial; they are contributions to a future where roads become intelligent conduits of information.

Safety Elevated: V2V and V2I Dynamics

The crux of V2X communication lies in its potential to elevate safety standards on the road. V2V communication enables vehicles to exchange real-time information about their speed, position, and direction, allowing for predictive analysis and timely warnings. Simultaneously, V2I communication ensures that vehicles are aware of traffic signals, road conditions, and potential hazards, creating a cohesive and responsive driving environment. Investing in companies driving advancements in V2V and V2I dynamics isn’t just about road safety; it’s about pioneering the next level of collision prevention and traffic management.

Efficiency Amplified: V2P and V2D Integration

Beyond safety, V2X communication enhances the efficiency of transportation systems. V2P communication allows vehicles to detect and communicate with pedestrians, reducing the risk of accidents at crosswalks and intersections. V2D integration extends the communication web to include devices such as smartphones and wearables, further enhancing the overall efficiency of smart transportation. Investments in companies pioneering V2P and V2D communication technologies position investors at the forefront of a connected ecosystem where efficiency isn’t just an aspiration but a tangible reality.

Strategic Considerations

The strategic dimensions of investing in V2X communication go beyond the immediate applications. Companies working on cybersecurity solutions for V2X networks, integrating blockchain for secure data exchange, and developing machine learning algorithms for intelligent traffic management represent additional facets of strategic investment opportunities. As the world embraces the era of smart transportation, those who strategically invest in V2X communication technologies are not just adapting to change; they are architects of a safer, more efficient future on our roads.

Investing in companies driving V2X communication technologies isn’t just about seeking returns; it’s about recognizing the transformative power these technologies hold in shaping the future of transportation. As smart cities and connected vehicles become integral to our daily lives, those who strategically position themselves within the realms of V2X communication are not just investors; they are contributors to a safer, more interconnected driving environment. The road to smart transportation is paved with communication, and within the domain of V2X lies a strategic investment landscape waiting to be explored.

Recycling and Sustainability

The shift towards eco-friendly practices, recycling, and the use of sustainable materials isn’t just a trend; it’s a paradigm shift reshaping the very foundations of automotive manufacturing. For investors with an eye on both profitability and planet-friendly initiatives, directing investments towards companies specializing in automotive recycling and sustainable practices is not just strategic; it’s a forward-thinking commitment to the industry’s future. This exploration traverses the green lanes of sustainability within the automotive sector, unveiling the investment opportunities that lie within the realms of recycling, sustainable materials, and eco-friendly manufacturing processes.

Recycling: Reshaping End-of-Life Vehicles

At the heart of sustainable automotive practices is recycling – a process that extends the life cycle of vehicles and minimizes the environmental impact of end-of-life vehicles. Investing in companies at the forefront of automotive recycling means participating in a green revolution where components and materials are repurposed, reducing the need for raw materials and minimizing waste. From salvaging usable parts to recycling metals and plastics, these companies aren’t just managing waste; they are architects of a circular automotive economy.

Sustainable Materials: Paving the Way for Greener Vehicles

The materials used in automotive manufacturing play a pivotal role in determining the environmental footprint of vehicles. Companies investing in sustainable materials, such as recycled plastics, bio-based composites, and responsibly sourced metals, are pioneering a new era in green manufacturing. Investing in these innovators means being part of a movement where vehicles are not just modes of transportation but ambassadors of sustainability. Sustainable materials investments go beyond reducing environmental impact; they represent a commitment to shaping the automotive industry as a beacon of responsible manufacturing.

Eco-Friendly Manufacturing Processes: Reducing Carbon Footprints

The manufacturing processes employed in the automotive industry are increasingly under scrutiny for their environmental impact. Companies adopting eco-friendly manufacturing practices, such as energy-efficient facilities, reduced water usage, and waste minimization, are setting new standards for environmental responsibility. Investing in these trailblazers means aligning with entities that recognize the importance of not only the final product but the entire production journey in fostering a sustainable future. These investments aren’t just about reducing carbon footprints; they are contributions to an automotive landscape where the manufacturing process itself is a testament to eco-consciousness.

Strategic Considerations

The strategic aspects of investing in recycling and sustainability within the automotive industry extend beyond immediate applications. Companies investing in research and development for green technologies, integrating circular economy principles into their business models, and collaborating with regulatory bodies for stricter environmental standards represent additional dimensions of strategic investment opportunities. As the world embraces a future where sustainability is not just a choice but a necessity, those who strategically invest in automotive recycling and eco-friendly practices aren’t just stakeholders; they are architects of an industry that harmonizes with the planet.

Investing in companies driving automotive recycling, sustainable materials, and eco-friendly manufacturing processes isn’t just about navigating market trends; it’s about recognizing the integral role these companies play in defining the future of the automotive industry. As environmental responsibility becomes a cornerstone of success, those who strategically position themselves within the realms of sustainability are not just investors; they are contributors to a greener, more resilient future. The road to automotive sustainability is paved with conscious choices, and within the domain of recycling and eco-friendly practices lies a strategic investment landscape waiting to be explored.