In a world where financial success is often measured solely by monetary gains, TacticInvest stands as a beacon of purposeful investing, where profit meets purpose and impact takes center stage. As the landscape of investment continues to evolve, so too does the collective consciousness of investors who seek not just returns, but a meaningful contribution to society and the planet.

At TacticInvest, we recognize the power of capital to drive positive change. Our mission is clear: to empower investors like you to align your financial goals with your values by offering a curated selection of the top ten investment options for impact investing. We understand that investing in companies that prioritize social and environmental impact is not just about maximizing returns, but about creating a better, more sustainable world for future generations.

From renewable energy projects to sustainable agriculture initiatives, microfinance institutions to green bonds, we provide access to a diverse range of investment opportunities that make a tangible difference in the world. With TacticInvest, you can invest with confidence, knowing that your capital is being channeled towards companies that are committed to making a positive social or environmental impact.

Join us on this journey towards purposeful investing, where every investment decision has the potential to shape a brighter future for us all. Together, let’s harness the power of finance to create lasting change and build a more equitable and sustainable world. Welcome to TacticInvest, where profit meets purpose, and impact investing is not just a tactic, but a transformative strategy for a better tomorrow.

| Investment Option | Description |

| Renewable Energy Projects | Investment in solar, wind, or hydroelectric power projects to reduce reliance on fossil fuels and lower greenhouse gas emissions. |

| Sustainable Agriculture | Investment in farming practices such as organic farming, agroforestry, and permaculture to promote soil health, biodiversity, and water conservation. |

| Microfinance | Investment in financial services for low-income individuals to start or expand businesses in developing countries, alleviating poverty and empowering entrepreneurs. |

| Green Bonds | Investment in fixed-income securities to finance environmentally beneficial projects like renewable energy, energy efficiency, and sustainable transport. |

| Community Development Financial Institutions (CDFIs) | Investment in financial institutions providing affordable lending and banking services to underserved communities, fostering economic empowerment. |

| Ethical Consumer Goods Companies | Investment in companies producing fair trade products, organic food, and eco-friendly household items, promoting sustainable consumption. |

| Water Infrastructure Projects | Investment in projects such as water treatment plants, wastewater management systems, and irrigation infrastructure to improve access to clean water and sanitation. |

| Education Initiatives | Investment in charter schools, vocational training programs, or educational technology startups to improve literacy rates, job skills, and socioeconomic mobility. |

| Healthcare Innovation | Investment in biotechnology companies, medical device manufacturers, and telemedicine platforms to advance medical research, improve healthcare access, and address global health challenges. |

| Impact Funds | Investment in funds pooling capital to support companies or projects generating positive social or environmental outcomes across various sectors. |

Renewable Energy Projects

In the quest for a sustainable future, one of the most compelling frontiers lies in the realm of renewable energy projects. From the majestic sweep of wind turbines to the glistening panels of solar arrays and the serene flow of hydroelectric dams, these innovations represent not just a shift in energy generation, but a profound transformation in our relationship with the planet.

The Promise of Renewable Energy

Renewable energy projects, encompassing solar, wind, and hydroelectric power, offer more than just an alternative to fossil fuels. They promise a future where our energy needs are met without sacrificing the health of the planet. By harnessing the natural elements that surround us, we can power our lives while reducing our carbon footprint and mitigating the impacts of climate change.

Solar Energy: Capturing the Sun’s Rays

At the forefront of the renewable energy revolution stands solar power. By capturing the boundless energy of the sun, solar panels transform sunlight into electricity with remarkable efficiency. From sprawling solar farms in sun-drenched deserts to rooftop installations on homes and businesses, solar energy projects are reshaping the landscape of power generation.

Investing in solar energy projects not only provides a lucrative financial opportunity but also contributes to a cleaner, more sustainable future. By supporting the expansion of solar infrastructure, investors can play a crucial role in accelerating the transition to renewable energy and reducing our reliance on fossil fuels.

Wind Energy: Harnessing Nature’s Breath

Wind energy, too, holds immense potential in our quest for renewable power. Wind turbines, with their elegant blades spinning gracefully in the breeze, have become a ubiquitous sight across landscapes worldwide. From offshore wind farms to wind turbines dotting the countryside, wind energy projects offer a reliable and abundant source of clean electricity.

Investing in wind energy projects not only offers attractive returns but also helps drive innovation in renewable technology. As wind turbines become more efficient and cost-effective, they have the potential to revolutionize the way we power our cities and communities, paving the way for a future powered by clean, renewable energy.

Hydroelectric Power: Tapping into Nature’s Flow

Among the oldest forms of renewable energy, hydroelectric power harnesses the energy of flowing water to generate electricity. From massive dams spanning rivers to small-scale hydroelectric plants nestled in mountain streams, hydroelectric projects have long been a cornerstone of clean energy production.

Investing in hydroelectric power projects offers investors the opportunity to support sustainable development while reaping steady returns. By leveraging the power of water, hydroelectric projects provide a reliable source of renewable energy that can help meet the growing demand for electricity without harming the environment.

Renewable energy projects represent not just a shift in how we power our world, but a fundamental reimagining of our relationship with the planet. By investing in solar, wind, and hydroelectric power projects, investors can contribute to a future where clean, sustainable energy is the norm rather than the exception.

As we stand on the brink of a new era of energy production, the opportunities for investment in renewable energy projects are boundless. Whether you’re motivated by financial returns, environmental stewardship, or a desire to leave a positive legacy for future generations, investing in renewable energy projects offers a chance to be part of something truly transformative.

Together, let’s harness the power of tomorrow and build a brighter, more sustainable future for all.

Sustainable Agriculture

In the heart of every verdant field and beneath the roots of every thriving crop lies the potential for a more sustainable future. Sustainable agriculture, with its focus on environmentally friendly practices such as organic farming, agroforestry, and permaculture, not only nurtures the land but also cultivates resilience in the face of ecological challenges. For investors seeking both financial returns and positive environmental impact, sustainable agriculture presents a fertile opportunity ripe for growth.

The Roots of Sustainable Agriculture

At its core, sustainable agriculture is a philosophy that recognizes the interconnectedness of ecosystems and seeks to work in harmony with nature rather than against it. By eschewing chemical fertilizers and pesticides in favor of natural alternatives, sustainable farmers protect soil health, preserve biodiversity, and safeguard water resources for future generations.

Organic Farming

One of the cornerstones of sustainable agriculture, organic farming eschews synthetic chemicals in favor of natural methods for pest control, soil fertility, and weed management. By relying on compost, crop rotation, and biological pest control, organic farmers cultivate healthy, nutrient-rich soil that supports the growth of vibrant, resilient crops.

Investing in organic farming not only supports farmers who prioritize environmental stewardship but also taps into a growing market demand for organic produce. As consumers become increasingly aware of the health and environmental benefits of organic food, the organic farming sector presents lucrative opportunities for investors seeking sustainable returns.

Agroforestry

Agroforestry blends the practices of agriculture and forestry to create diverse, multi-functional landscapes that benefit both farmers and the environment. By integrating trees into agricultural systems, agroforestry improves soil fertility, enhances biodiversity, and provides valuable ecosystem services such as carbon sequestration and erosion control.

Investing in agroforestry projects offers investors the chance to support innovative land management practices that promote sustainability and resilience in the face of climate change. From shade-grown coffee plantations to fruit orchards interplanted with native trees, agroforestry projects offer a compelling opportunity to generate both financial returns and positive social and environmental impact.

Permaculture

Permaculture, derived from the words “permanent” and “agriculture,” is a design system that seeks to create sustainable human habitats by mimicking the patterns and principles found in nature. By emphasizing principles such as diversity, efficiency, and resilience, permaculture practitioners create self-sustaining ecosystems that produce food, fiber, and other resources in harmony with the natural world.

Investing in permaculture initiatives supports the development of regenerative agricultural systems that restore degraded landscapes, build soil health, and promote community resilience. Whether through supporting permaculture education and training programs or investing in permaculture-based enterprises, investors can play a vital role in advancing the transition to more sustainable, resilient food systems.

Sustainable agriculture holds the key to a more resilient, equitable, and regenerative future for our planet. By investing in practices such as organic farming, agroforestry, and permaculture, investors can support farmers who are pioneering innovative solutions to the pressing environmental challenges of our time.

As we stand at the crossroads of a changing climate and a growing global population, the need for sustainable agriculture has never been more urgent. By channeling capital towards sustainable farming practices, investors can not only generate financial returns but also sow the seeds of positive environmental and social change that will yield dividends for generations to come.

Microfinance

In the bustling streets of developing countries, where dreams often outweigh resources, microfinance emerges as a beacon of hope for millions striving to break free from the cycle of poverty. Microfinance institutions, with their mission to provide financial services to low-income individuals excluded from traditional banking systems, offer more than just access to capital – they offer a pathway to economic empowerment and social transformation.

Unlocking Opportunity for the Unbanked

For many low-income individuals and small-scale entrepreneurs in developing countries, access to formal financial services remains an elusive dream. Traditional banks, burdened by stringent requirements and bureaucratic hurdles, often overlook these marginalized communities, leaving them without the means to start or expand their businesses.

Enter microfinance institutions, which bridge the gap between financial exclusion and economic opportunity. By offering small loans, savings accounts, insurance, and other financial services tailored to the needs of the poor, microfinance institutions empower individuals to invest in their futures, build assets, and lift themselves out of poverty.

Investing in Human Potential

Investing in microfinance isn’t just about chasing financial returns – it’s about recognizing the untapped potential of millions of entrepreneurs and small businesses in developing countries. By providing them with the tools they need to succeed, microfinance investors play a vital role in unlocking human potential and driving sustainable economic development.

Microfinance investment offers a unique opportunity to make a tangible difference in the lives of marginalized communities while generating attractive returns. By channeling capital towards microfinance institutions that prioritize social impact alongside financial sustainability, investors can create positive ripple effects that extend far beyond their bottom line.

Alleviating Poverty, One Loan at a Time

The impact of microfinance extends far beyond the individual borrower – it reaches into entire communities, transforming lives and lifting families out of poverty. When a small-scale entrepreneur receives a microloan to start or expand a business, they not only improve their own standard of living but also create jobs, stimulate local economies, and inspire others to pursue their entrepreneurial dreams.

Investing in microfinance is investing in the power of human potential to overcome adversity and create a better future for all. By providing low-income individuals with the means to access capital, build assets, and improve their livelihoods, microfinance investors become catalysts for lasting change and poverty alleviation on a global scale.

In a world where financial exclusion continues to perpetuate cycles of poverty and inequality, microfinance offers a glimmer of hope for those left behind by traditional banking systems. By investing in microfinance, individuals and institutions alike can become agents of change, empowering entrepreneurs, uplifting communities, and building a more inclusive and prosperous world for generations to come.

Green Bonds

In a world facing unprecedented environmental challenges, the demand for innovative solutions has never been greater. Enter green bonds – a financial instrument designed to mobilize capital towards projects that not only generate financial returns but also deliver positive environmental and climate benefits. As the global community grapples with the urgent need to transition to a low-carbon, sustainable future, green bonds offer investors a unique opportunity to align their portfolios with their values and make a tangible impact on the planet.

Fueling Environmental Progress

At their core, green bonds represent a commitment to environmental stewardship and climate action. Issued by governments, municipalities, corporations, and financial institutions, these fixed-income securities raise capital specifically earmarked for projects that promote sustainability and mitigate climate change. From renewable energy installations to energy-efficient buildings, sustainable transportation infrastructure to climate resilience initiatives, the scope of green bond-funded projects is as diverse as the environmental challenges they seek to address.

Renewable Energy

One of the most prominent sectors financed by green bonds is renewable energy. As the world seeks to reduce its dependence on fossil fuels and transition to cleaner, more sustainable sources of energy, green bonds play a pivotal role in financing the construction of solar farms, wind turbines, hydroelectric plants, and other renewable energy infrastructure projects. By investing in green bonds, individuals and institutions can contribute to the expansion of renewable energy capacity and accelerate the shift towards a carbon-neutral energy system.

Energy Efficiency

Another key focus area for green bonds is energy efficiency. By investing in projects that improve the efficiency of buildings, appliances, and industrial processes, green bonds help reduce energy consumption, lower greenhouse gas emissions, and save money for both businesses and consumers. From retrofitting existing buildings with energy-efficient lighting and insulation to financing the development of advanced energy-saving technologies, green bonds drive innovation and progress in the field of energy efficiency.

Sustainable Transport

Transportation is a significant contributor to global carbon emissions, making it a prime target for green bond investment. Projects funded by green bonds in the transportation sector include the development of electric vehicle infrastructure, the expansion of public transportation systems, and the construction of bike lanes and pedestrian-friendly infrastructure. By investing in sustainable transport initiatives, green bond investors can help reduce air pollution, alleviate traffic congestion, and promote healthier, more livable cities.

Climate Adaptation

As the impacts of climate change become increasingly apparent, there is a growing need to invest in projects that enhance climate resilience and adaptation. Green bonds finance initiatives such as flood protection infrastructure, drought-resistant agriculture, coastal restoration projects, and resilient water management systems. By investing in climate adaptation projects, green bond investors can help communities prepare for the inevitable challenges posed by a changing climate and build a more resilient future for all.

Green bonds offer investors a powerful tool to deploy capital towards projects that not only generate financial returns but also create positive environmental and social impact. By investing in renewable energy, energy efficiency, sustainable transport, and climate adaptation initiatives, green bond investors can play a vital role in driving the transition to a more sustainable, resilient future. As the demand for sustainable investment options continues to grow, green bonds stand out as a compelling opportunity for individuals and institutions alike to invest with purpose and make a meaningful difference in the world.

Impact Funds

In a world rife with social and environmental challenges, the need for innovative solutions has never been more pressing. Enter impact funds – a dynamic and transformative force in the realm of finance, harnessing the collective power of investors to drive positive change on a global scale. By pooling investments and allocating capital to companies and projects with the potential to generate meaningful social or environmental outcomes, impact funds are reshaping the landscape of finance and paving the way for a more sustainable and equitable future.

A New Paradigm in Investing

At the heart of impact funds lies a fundamental shift in the way we perceive the role of capital in society. Gone are the days when financial success was measured solely by monetary gains – today, investors are increasingly recognizing the importance of aligning their portfolios with their values and making a positive impact on the world. Impact funds offer a means to do just that, providing investors with the opportunity to leverage their capital for social and environmental good while still achieving competitive financial returns.

Pooling Resources for Greater Impact

One of the defining features of impact funds is their ability to pool investments from a diverse range of investors – from individuals and family offices to institutional investors and philanthropic organizations. By aggregating capital on a larger scale, impact funds are able to amplify their impact and support a broader array of projects and initiatives than would be possible with individual investments alone. This pooling of resources enables impact funds to tackle some of the most pressing challenges facing society today, from climate change and environmental degradation to poverty alleviation and healthcare access.

Targeted Investments for Maximum Impact

Impact funds may focus on specific themes or sectors that align with their mission and investment objectives. For example, some impact funds may specialize in clean energy projects, investing in renewable energy infrastructure and technologies that reduce carbon emissions and combat climate change. Others may focus on affordable housing initiatives, financing the development of sustainable and affordable housing solutions for low-income communities. Still, others may target healthcare access, investing in companies and organizations that provide essential healthcare services to underserved populations.

Measuring What Matters

One of the key challenges facing impact funds is how to effectively measure and track their social and environmental impact. Unlike traditional financial metrics, which are relatively straightforward to quantify, impact metrics can be more complex and nuanced. Impact funds may use a variety of tools and methodologies to assess their impact, including environmental, social, and governance (ESG) criteria, as well as more specialized impact measurement frameworks such as the Impact Reporting and Investment Standards (IRIS) or the Sustainable Development Goals (SDGs) framework.

A Force for Positive Change

In an age of increasing social and environmental awareness, impact funds are emerging as a powerful force for positive change. By harnessing the collective power of investors and directing capital towards projects and initiatives that address pressing social and environmental challenges, impact funds are driving innovation, fostering sustainable development, and creating lasting positive change in communities around the world. As the demand for impact investing continues to grow, impact funds are poised to play an increasingly influential role in shaping the future of finance and building a more sustainable and equitable world for generations to come.

Community Development Financial Institutions (CDFIs)

In the landscape of finance, where profit often takes precedence over people, Community Development Financial Institutions (CDFIs) stand as beacons of hope, champions of economic justice, and catalysts for community empowerment. These specialized financial institutions play a vital role in bridging the gap between underserved communities and mainstream financial services, providing affordable lending and banking services to those who need them most. By investing in CDFIs, individuals and institutions alike have the power to support community development, foster economic empowerment, and create lasting positive change in the lives of millions.

A Lifeline for Underserved Communities

For many low-income individuals, small businesses, and nonprofit organizations, access to affordable financial services can be a lifeline in the face of economic hardship. Yet, all too often, these communities find themselves excluded from traditional banking systems, left to navigate a maze of predatory lenders and exploitative practices. This is where CDFIs step in, offering a ray of hope and a pathway to financial stability.

CDFIs are mission-driven financial institutions that prioritize social impact alongside financial returns. They serve as vital sources of capital for underserved communities, providing loans, credit, and other financial services on fair and equitable terms. Whether it’s a small business seeking startup capital, a low-income family in need of affordable housing financing, or a nonprofit organization looking to expand its community programs, CDFIs are there to lend a helping hand.

Investing in Community Development

Investing in CDFIs is more than just a financial decision – it’s a commitment to community development and economic empowerment. By channeling capital towards CDFIs, investors can support initiatives that promote financial inclusion, stimulate local economies, and uplift marginalized communities. Whether through direct investments, deposits, or participation in CDFI loan funds, investors have the power to make a meaningful difference in the lives of those who need it most.

CDFIs operate at the intersection of finance and social justice, leveraging the power of capital to address systemic inequalities and build more inclusive, resilient communities. By investing in CDFIs, individuals and institutions can align their financial goals with their values, creating a ripple effect of positive change that extends far beyond the balance sheet.

Creating Opportunities for All

At their core, CDFIs embody the principle that financial services should be accessible to all, regardless of income level or zip code. They provide a lifeline for communities that have been historically marginalized and underserved by traditional financial institutions, offering hope, opportunity, and a pathway to economic self-sufficiency.

By investing in CDFIs, individuals and institutions can become partners in community development, working together to build a more equitable and inclusive society. Whether it’s providing affordable housing, supporting small businesses, or investing in education and workforce development, CDFIs are at the forefront of creating opportunities for all.

In a world where economic inequality and social injustice continue to pose significant challenges, CDFIs offer a ray of hope and a path forward. By investing in these mission-driven financial institutions, individuals and institutions can play a vital role in creating positive change in their communities and beyond. Together, let’s harness the power of finance for good, build stronger, more resilient communities, and create a brighter future for all.

Ethical Consumer Goods Companies

In a world where consumer choices have far-reaching consequences, ethical consumer goods companies stand as beacons of sustainability, integrity, and conscious consumption. These companies, driven by a commitment to social and environmental responsibility, produce a wide array of products – from fair trade coffee and organic food to eco-friendly household items – that not only nourish the body and home but also nurture the planet and support communities worldwide. By investing in these trailblazing companies, individuals and institutions alike have the power to promote sustainable consumption and production practices, driving positive change for the planet and future generations.

The Rise of Ethical Consumerism

In recent years, consumers have become increasingly aware of the impact their purchasing decisions have on the world around them. From deforestation and pollution to labor exploitation and human rights abuses, the negative consequences of traditional consumerism have become impossible to ignore. In response, a growing number of consumers are seeking out products that align with their values – products that are ethically produced, environmentally friendly, and socially responsible.

Ethical consumer goods companies have emerged to meet this demand, offering products that prioritize sustainability, transparency, and ethical sourcing. From fair trade chocolate and cruelty-free cosmetics to organic cotton clothing and biodegradable cleaning products, these companies are leading the charge towards a more ethical and sustainable future.

Investing in Sustainability

Investing in ethical consumer goods companies is not just about financial returns – it’s about investing in a vision of a better world. By supporting companies that prioritize ethical and sustainable practices, investors can help drive positive change across industries and promote more responsible consumption habits.

Ethical consumer goods companies operate on the principle that business can be a force for good – that profitability and social responsibility are not mutually exclusive. By investing in these companies, individuals and institutions can align their financial goals with their values, creating a ripple effect of positive impact that extends far beyond the balance sheet.

Promoting Sustainable Consumption

At the heart of ethical consumer goods companies lies a commitment to promoting sustainable consumption and production practices. By producing goods that are ethically sourced, environmentally friendly, and socially responsible, these companies are helping to shift the paradigm of consumerism towards a more sustainable and equitable future.

Investing in ethical consumer goods companies is an investment in sustainability – in a world where resources are finite and environmental degradation is a growing concern, supporting companies that prioritize sustainability is more important than ever. By investing in these companies, individuals and institutions can play a crucial role in promoting more responsible consumption habits and building a brighter, more sustainable future for all.

In a world where every purchase has an impact, ethical consumer goods companies offer a beacon of hope and a pathway to a more sustainable future. By investing in these companies, individuals and institutions can harness the power of finance to drive positive change and promote more responsible consumption habits. Together, let’s support companies that are leading the charge towards a more ethical, sustainable, and equitable world for generations to come.

Water Infrastructure Projects

In the intricate tapestry of global development, few issues are as fundamental – or as urgent – as access to clean water. Yet, in many parts of the world, water scarcity remains a pressing challenge, with millions of people lacking access to safe drinking water and basic sanitation services. In the face of this crisis, water infrastructure projects emerge as not just a solution, but a lifeline – offering hope, health, and a pathway to prosperity for communities in need.

The Crucial Role of Water Infrastructure

Water infrastructure projects encompass a wide range of initiatives aimed at improving water access, quality, and management. From the construction of water treatment plants and wastewater management systems to the development of irrigation infrastructure and rainwater harvesting facilities, these projects play a vital role in addressing water scarcity and ensuring access to clean water for all.

Investing in water infrastructure is not just about building pipes and treatment facilities – it’s about investing in the health, well-being, and future of communities around the world. By supporting projects that improve water access and sanitation, investors can make a tangible difference in the lives of millions, while also driving economic development, promoting public health, and protecting the environment.

Addressing Water Scarcity

Water scarcity is a growing concern in many parts of the world, driven by factors such as population growth, urbanization, climate change, and unsustainable water management practices. In the face of this crisis, water infrastructure projects offer a ray of hope – providing communities with the tools they need to effectively manage and conserve their water resources.

Investing in water infrastructure projects can help mitigate the impacts of water scarcity by improving water storage, distribution, and management systems. Whether through the construction of dams and reservoirs, the implementation of water conservation measures, or the development of efficient irrigation techniques, these projects are essential for ensuring water security and resilience in the face of a changing climate.

Improving Access to Clean Water

Access to clean water is a basic human right, yet millions of people around the world still lack access to safe drinking water and sanitation services. Water infrastructure projects play a crucial role in improving water access and quality, particularly in underserved communities where access to clean water is limited or non-existent.

Investing in water infrastructure projects can help provide communities with access to clean water for drinking, cooking, and sanitation, improving public health, reducing the risk of waterborne diseases, and promoting overall well-being. By supporting projects that expand water access and sanitation services, investors can contribute to the achievement of the United Nations Sustainable Development Goal 6 – ensuring access to clean water and sanitation for all by 2030.

In a world where access to clean water is increasingly threatened, investing in water infrastructure projects is not just a smart financial decision – it’s a moral imperative. By supporting projects that improve water access, quality, and management, investors can make a meaningful difference in the lives of millions, while also promoting sustainable development, protecting public health, and safeguarding the environment. Together, let’s build a future where clean water is not just a privilege, but a fundamental human right for all.

Education Initiatives

In the mosaic of human progress, few endeavors hold as much transformative potential as education. From unlocking minds and expanding horizons to fostering economic opportunity and social mobility, investing in education initiatives lies at the heart of building a brighter, more equitable future for all. Whether through supporting charter schools, vocational training programs, or educational technology startups, investing in education is not just an investment in knowledge – it’s an investment in the promise of a better tomorrow.

Unlocking Human Potential

Education is more than just the transfer of knowledge – it’s the key that unlocks human potential and empowers individuals to reach their fullest capabilities. By investing in education initiatives, individuals and institutions alike have the power to transform lives, break the cycle of poverty, and create pathways to prosperity for future generations.

Whether it’s supporting charter schools that provide innovative and personalized learning experiences, vocational training programs that equip individuals with in-demand job skills, or educational technology startups that harness the power of digital innovation to expand access to quality education, investing in education initiatives opens doors to new opportunities and paves the way for success.

Fostering Economic Opportunity

At its core, education is a catalyst for economic opportunity and social mobility. By investing in education initiatives, investors can contribute to improving literacy rates, job skills, and workforce readiness – essential ingredients for a thriving economy and a prosperous society.

Charter schools offer alternative models of education that cater to the diverse needs and interests of students, providing opportunities for personalized learning and academic excellence. Vocational training programs equip individuals with the practical skills and hands-on experience needed to succeed in today’s job market, filling critical gaps in the workforce and driving economic growth.

Educational technology startups leverage the power of digital innovation to revolutionize the way we teach and learn, expanding access to quality education and leveling the playing field for students from all backgrounds. By investing in these startups, investors can support the development of cutting-edge tools and technologies that have the potential to transform education on a global scale.

Building a Better Future

Investing in education initiatives is not just about preparing individuals for the jobs of today – it’s about equipping them with the skills, knowledge, and mindset they need to thrive in the jobs of tomorrow. By investing in education, we invest in the future – a future where every individual has the opportunity to reach their full potential, regardless of their background or circumstances.

As we stand at the crossroads of a rapidly changing world, the importance of investing in education initiatives has never been more apparent. By supporting charter schools, vocational training programs, and educational technology startups, investors can play a pivotal role in shaping the future of education and building a better, more equitable world for generations to come. Together, let’s unlock the power of education and unleash human potential on a global scale.

Healthcare Innovation

In the ever-evolving landscape of healthcare, innovation stands as the cornerstone of progress – driving breakthroughs in medical research, expanding access to healthcare services, and revolutionizing the way we approach global health challenges. From biotechnology companies pushing the boundaries of medical science to medical device manufacturers developing cutting-edge technologies and telemedicine platforms bridging the gap between patients and providers, investing in healthcare innovation is not just a financial opportunity – it’s a catalyst for change that has the power to transform lives and reshape the future of healthcare as we know it.

Breaking New Ground in Medical Research

At the forefront of healthcare innovation lies the field of biotechnology, where scientists and researchers are unlocking the secrets of the human body and developing novel treatments and therapies for a wide range of diseases and conditions. By investing in biotechnology companies, investors have the opportunity to support groundbreaking research and development efforts that have the potential to save lives and improve health outcomes for millions of people worldwide.

From gene therapies and personalized medicine to immunotherapies and regenerative medicine, the possibilities are endless when it comes to healthcare innovation. By providing capital to biotechnology companies, investors can help fuel the next wave of medical breakthroughs and accelerate the pace of innovation in the fight against disease.

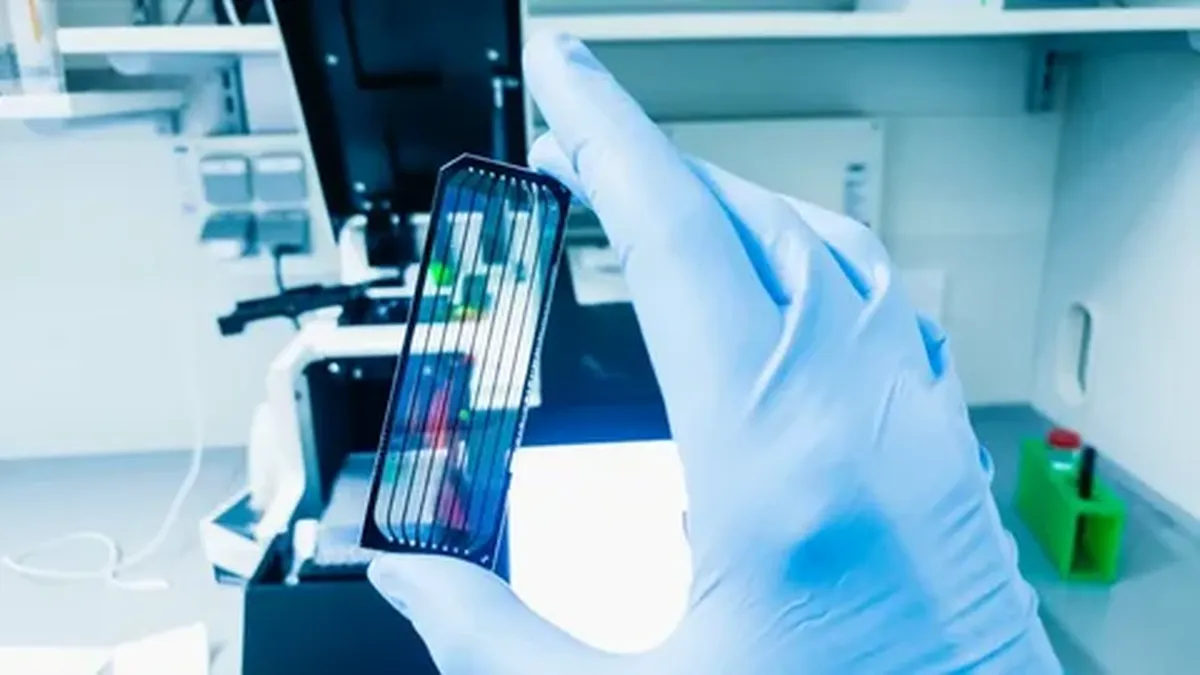

Advancing Medical Technology

In addition to biotechnology, medical device manufacturers play a crucial role in driving healthcare innovation forward. These companies develop and produce a wide range of devices and technologies – from diagnostic tools and imaging equipment to surgical instruments and prosthetics – that enhance patient care, improve treatment outcomes, and revolutionize medical practice.

Investing in medical device manufacturers allows investors to support the development and commercialization of innovative technologies that have the potential to transform healthcare delivery. Whether it’s a new medical imaging device that provides clearer and more accurate diagnostic images or a minimally invasive surgical tool that reduces patient recovery times, investing in medical technology companies can have a tangible impact on patient care and medical outcomes.

Expanding Access to Healthcare Services

In addition to driving medical research and technological innovation, healthcare innovation also includes efforts to improve access to healthcare services for underserved populations. Telemedicine platforms, for example, leverage digital technology to connect patients with healthcare providers remotely, expanding access to medical care in rural and underserved areas where traditional healthcare infrastructure may be lacking.

By investing in telemedicine platforms, investors can support initiatives that improve healthcare access and reduce disparities in healthcare delivery. Whether it’s providing virtual consultations with specialists, delivering remote monitoring and management services for chronic conditions, or facilitating telehealth visits in rural communities, telemedicine platforms have the potential to revolutionize the way we deliver and receive healthcare services.

Addressing Global Health Challenges

Finally, investing in healthcare innovation is also about addressing some of the most pressing global health challenges facing humanity today. From infectious diseases and pandemics to chronic conditions and non-communicable diseases, healthcare innovation has the potential to transform our response to these challenges and improve health outcomes for people around the world.

Whether it’s developing new vaccines and treatments for emerging infectious diseases, implementing innovative public health interventions to combat chronic conditions like diabetes and heart disease, or deploying telemedicine solutions to provide medical care in humanitarian crises, investing in healthcare innovation is essential for building a healthier, more resilient world.

As we look to the future of healthcare, one thing is clear: innovation will be the driving force behind progress. By investing in healthcare innovation – whether through biotechnology companies, medical device manufacturers, or telemedicine platforms – investors have the opportunity to support initiatives that advance medical research, improve access to healthcare services, and address global health challenges.

As the world continues to grapple with the COVID-19 pandemic and other health crises, the importance of investing in healthcare innovation has never been more apparent. By providing capital to companies and initiatives at the forefront of medical science and technology, investors can play a crucial role in shaping the future of healthcare and building a healthier, more resilient world for generations to come.