In recent years, there has been a growing awareness of the impact of business and investment on the environment and society. As a result, sustainable investing has emerged as a popular option for individuals who want to make a positive impact with their investments.

Sustainable investing involves investing in companies that are committed to ethical and sustainable business practices, such as reducing carbon emissions, promoting social justice, and maintaining strong corporate governance.

In this article, we will explore the top 20 sustainable investment opportunities that are making a positive impact on the environment and society. Whether you’re interested in renewable energy, sustainable agriculture, or clean technology, there is an opportunity for everyone to invest in a better world.

Renewable Energy: Investing in companies that produce renewable energy

As the world continues to grapple with climate change, renewable energy has emerged as a key solution to reducing carbon emissions. Investing in companies that produce renewable energy is not only socially responsible, but it can also yield significant financial returns. Here are some companies that are leading the charge in renewable energy and offer potential investment opportunities.

Enphase Energy

Enphase Energy is a company that produces microinverters for solar panels. Unlike traditional inverters that convert DC to AC power for an entire solar panel array, microinverters convert DC to AC power for each individual panel. This results in higher energy production and better system monitoring. Enphase Energy is a rapidly growing company and has seen a surge in demand for its products.

First Solar

First Solar is a company that produces thin-film solar panels. These panels are made with a thin layer of semiconductor material and have a lower carbon footprint than traditional silicon-based solar panels. First Solar has a strong track record of profitability and has established itself as a leader in the solar industry.

Tesla

Tesla is a well-known company that produces electric vehicles, but it also has a division that produces solar panels and energy storage systems. Tesla’s solar panels are sleek and efficient, and its energy storage systems are designed to integrate with solar panels to provide backup power during blackouts. Tesla has a strong brand and a dedicated customer base, which makes it a promising investment opportunity.

Orsted

Orsted is a Danish company that produces offshore wind turbines. It has a strong presence in Europe and has recently entered the US market. Orsted is committed to sustainable practices and has set a goal to be carbon neutral by 2025. Its offshore wind turbines are among the most efficient in the world and have the potential to provide clean energy to millions of people.

Investing in companies that produce renewable energy is not only a smart financial decision but also a way to contribute to a better future. These companies are at the forefront of innovation and have the potential to make a significant impact on the world.

Sustainable Agriculture: Investing in companies that promote sustainable agriculture practices

In a world where environmental sustainability is becoming increasingly important, investors are looking for ways to make a positive impact with their investments. One promising area for investment is sustainable agriculture, which involves practices that promote environmental health, social responsibility, and economic viability. Here are some reasons why investing in companies that promote sustainable agriculture practices can be a smart choice:

Environmental benefits

Sustainable agriculture practices focus on reducing the use of harmful chemicals and fertilizers, conserving water, and protecting biodiversity. This can result in healthier soils, improved air and water quality, and reduced greenhouse gas emissions. By investing in companies that promote sustainable agriculture, you can support these efforts and contribute to a more sustainable future.

Social responsibility

Sustainable agriculture practices also prioritize social responsibility, including fair treatment of workers and support for local communities. Investing in companies that prioritize social responsibility can help ensure that your money is supporting positive social outcomes, such as improved working conditions and stronger local economies.

Economic viability

Sustainable agriculture practices can also be good for business. By reducing costs associated with chemical inputs and improving soil health, farmers can often achieve higher yields and better quality crops. This can translate to higher profits and better financial outcomes for companies that promote sustainable agriculture practices.

Some examples of companies that promote sustainable agriculture practices include:

- Indigo Agriculture, which develops microbial products that help reduce the need for chemical inputs and improve soil health.

- Farmers Business Network, which provides farmers with tools and resources to optimize their operations and reduce costs.

- The Climate Corporation, which uses data science and technology to help farmers make more informed decisions and improve crop yields.

Clean Technology: Investing in companies that develop innovative technologies

The global transition to clean energy has gained momentum in recent years, prompting a growing number of investors to seek opportunities in the clean technology sector. Clean technology refers to the development of innovative solutions that aim to reduce or eliminate negative environmental impacts, while also providing sustainable economic growth. Investing in companies that are pioneering clean technologies can yield both financial and environmental returns, positioning investors to not only reap benefits but also contribute to a more sustainable future.

Clean Technology: An Emerging Market

The clean technology market is a fast-growing and dynamic sector, with a diverse range of companies developing innovative solutions across various industries. The global market for clean technology is projected to reach $1.3 trillion by 2025, with renewable energy, energy storage, and electric vehicles being some of the most promising sub-sectors. The rising demand for clean technologies is driven by a growing recognition of the negative environmental impacts of traditional energy sources, as well as the need to mitigate climate change.

Investing in Clean Technology: Key Considerations

Investing in clean technology requires careful consideration of various factors, including market trends, the competitive landscape, and regulatory frameworks. Here are some key considerations to keep in mind when investing in clean technology:

- Market Trends: Understanding market trends is crucial when investing in clean technology. Some of the trends to watch out for include the adoption of renewable energy sources, the growth of electric vehicles, and the development of energy storage solutions.

- Competitive Landscape: The clean technology sector is highly competitive, with many companies vying for market share. Investors should carefully evaluate the competitive landscape of the companies they are considering investing in, including factors such as product differentiation, market share, and pricing strategies.

- Regulatory Frameworks: The regulatory landscape plays a significant role in the clean technology sector. Investors should keep a close eye on regulatory developments, including policies that incentivize the adoption of clean technologies or impose penalties for companies that fail to meet environmental standards.

Benefits of Investing in Clean Technology

Investing in clean technology offers a range of benefits, including financial returns and the potential to contribute to a more sustainable future. Here are some of the key benefits of investing in clean technology:

- Financial Returns: The clean technology sector offers significant growth potential, with many companies experiencing rapid revenue growth. Investing in clean technology companies can yield strong financial returns, especially for those who invest early in promising companies.

- Environmental Benefits: Investing in clean technology also offers environmental benefits, as it supports the development of innovative solutions that aim to reduce or eliminate negative environmental impacts.

- Social Benefits: Investing in clean technology can also have positive social impacts, such as creating jobs in the clean energy sector and promoting sustainable economic growth.

Sustainable Transportation: Investing in companies that promote sustainable transportation

In today’s fast-paced world, the importance of sustainable transportation cannot be overstated. With the ever-increasing concern for the environment, investing in companies that promote sustainable transportation has become a popular choice among investors who care about the future of our planet. Here are some reasons why sustainable transportation is worth investing in:

Environmental benefits

Sustainable transportation companies promote a cleaner and greener environment. By investing in them, you contribute to reducing air pollution, greenhouse gas emissions, and other harmful effects of transportation on the environment. These companies use alternative fuels, electric vehicles, and other sustainable means of transportation to reduce their carbon footprint and promote a more sustainable future.

Economic benefits

Investing in sustainable transportation can also provide economic benefits. As the demand for sustainable transportation increases, the market for these companies also grows. Investing in these companies early on can lead to substantial returns as their market value increases over time.

Social benefits

Investing in sustainable transportation companies not only benefits the environment and the economy but also the community. These companies create job opportunities, promote sustainable living, and help to reduce traffic congestion, making transportation more accessible and convenient for everyone.

So, if you’re looking to invest in a sustainable future, here are some companies worth considering:

Tesla Inc.

Tesla is a leading sustainable transportation company that designs, manufactures, and sells electric vehicles, solar panels, and energy storage systems. The company’s mission is to accelerate the world’s transition to sustainable energy, and it has made significant strides towards achieving this goal.

Proterra Inc.

Proterra is a sustainable transportation company that designs and manufactures electric buses. The company’s buses have zero-emission technology and are a popular choice for public transportation in many cities.

ChargePoint Inc.

ChargePoint is a sustainable transportation company that provides electric vehicle charging solutions. The company’s charging stations are located in various locations, including commercial buildings, homes, and public spaces, making it convenient for electric vehicle owners to charge their cars.

Green Building: Investing in companies that focus on sustainable building practices and materials

Investing in companies that specialize in green building practices and materials can not only have a positive impact on the environment, but also yield significant financial returns. Here are some key reasons why investing in green building is a smart choice for the future:

Growing Demand for Sustainable Buildings

As awareness of environmental issues increases, so does demand for sustainable building practices. Many people are now willing to pay a premium for homes or offices that are built using sustainable materials and methods, which makes green building an attractive option for developers and investors alike.

Government Support for Green Building

Governments around the world are beginning to offer incentives and regulations to encourage green building practices. For example, in the United States, the Energy Policy Act of 2005 offers tax deductions for energy-efficient commercial buildings, while the European Union has set targets for all new buildings to be nearly zero-energy by 2021. This kind of support can help to drive demand for green building practices and materials.

Long-Term Cost Savings

While the initial cost of building with sustainable materials may be higher than traditional building methods, the long-term cost savings can be significant. Energy-efficient buildings can reduce energy costs by up to 50%, while sustainable materials can last longer and require less maintenance than traditional materials.

Positive Environmental Impact

Green building practices can have a significant positive impact on the environment. For example, buildings account for nearly 40% of global greenhouse gas emissions, and green building practices can help to reduce these emissions by up to 70%. Additionally, sustainable materials can be sourced from renewable resources and recycled materials, reducing the environmental impact of construction.

Water Management: Investing in companies that develop innovative solutions for water conservation and management

As climate change intensifies, water scarcity is becoming a significant concern worldwide. As a result, investing in companies that develop innovative solutions for water conservation and management has become a viable option. By investing in these companies, not only do you contribute to a more sustainable future, but you can also benefit from the economic growth and potential return on investment.

Here are some pioneering companies to consider when investing in water conservation and management:

Xylem Inc.

Xylem Inc. is a leading global water technology company that specializes in water treatment, transport, and testing. The company offers innovative solutions that help customers manage and conserve water efficiently. Their technologies include smart meters, leak detection, and water quality monitoring systems.

Evoqua Water Technologies

Evoqua Water Technologies is a company that provides a comprehensive range of water treatment solutions. They offer services that range from water purification and wastewater treatment to desalination and reuse. The company has a strong focus on sustainability, and their technologies have helped many businesses reduce their water consumption.

American Water Works

American Water Works is the largest publicly-traded water and wastewater utility company in the United States. They offer water and wastewater services to over 15 million people across 46 states. The company is committed to providing high-quality and affordable water services while protecting the environment.

SUEZ

SUEZ is a multinational company that specializes in water and waste management services. Their innovative solutions include water treatment, resource recovery, and waste-to-energy services. The company operates in over 70 countries, and their services have helped many communities worldwide to conserve and manage water resources.

Danaher Corporation

Danaher Corporation is a global science and technology company that specializes in innovative solutions for water quality testing and analysis. Their products include water testing instruments, laboratory equipment, and data management software. These technologies have helped many businesses to maintain high-quality water standards.

Sustainable Fashion: Investing in companies that prioritize sustainable and ethical production methods

The fashion industry has come under scrutiny in recent years for its negative environmental and social impact. From exploitative labor practices to wasteful production processes, the industry has a long way to go towards becoming truly sustainable. However, a growing number of fashion companies are recognizing the importance of ethical and eco-friendly production methods and are making changes to their practices. For investors looking to make a positive impact on the world while also achieving financial returns, allocating capital towards these companies can be a smart move.

Why Invest in Sustainable Fashion?

Investing in sustainable fashion has several benefits, including:

- Positive Impact: By investing in companies that prioritize sustainability and ethical practices, investors can contribute to a more just and equitable fashion industry, as well as a healthier planet.

- Financial Returns: While sustainable fashion is still a relatively niche industry, it is growing rapidly and presents opportunities for investors to achieve financial returns. Additionally, consumers are increasingly demanding sustainable and ethical products, which can drive sales for companies that prioritize these values.

- Risk Mitigation: Companies that prioritize sustainability and ethical practices may be better positioned to weather environmental, social, and governance (ESG) risks. For example, companies that use eco-friendly materials may be less susceptible to supply chain disruptions due to climate change-related events.

How to Invest in Sustainable Fashion?

Investors looking to allocate capital towards sustainable fashion can consider the following options:

- Direct Investment: Investors can invest directly in sustainable fashion companies through private equity or venture capital funds. These funds typically focus on early-stage companies that are developing innovative solutions for sustainable fashion.

- Public Equities: There are several publicly-traded companies that prioritize sustainability and ethical practices in the fashion industry. Investors can research and invest in these companies through traditional brokerage accounts.

- ESG-Focused Funds: Many mutual funds and exchange-traded funds (ETFs) now incorporate ESG criteria into their investment strategies. These funds may hold positions in sustainable fashion companies, providing investors with exposure to the industry while also achieving diversification across other sectors.

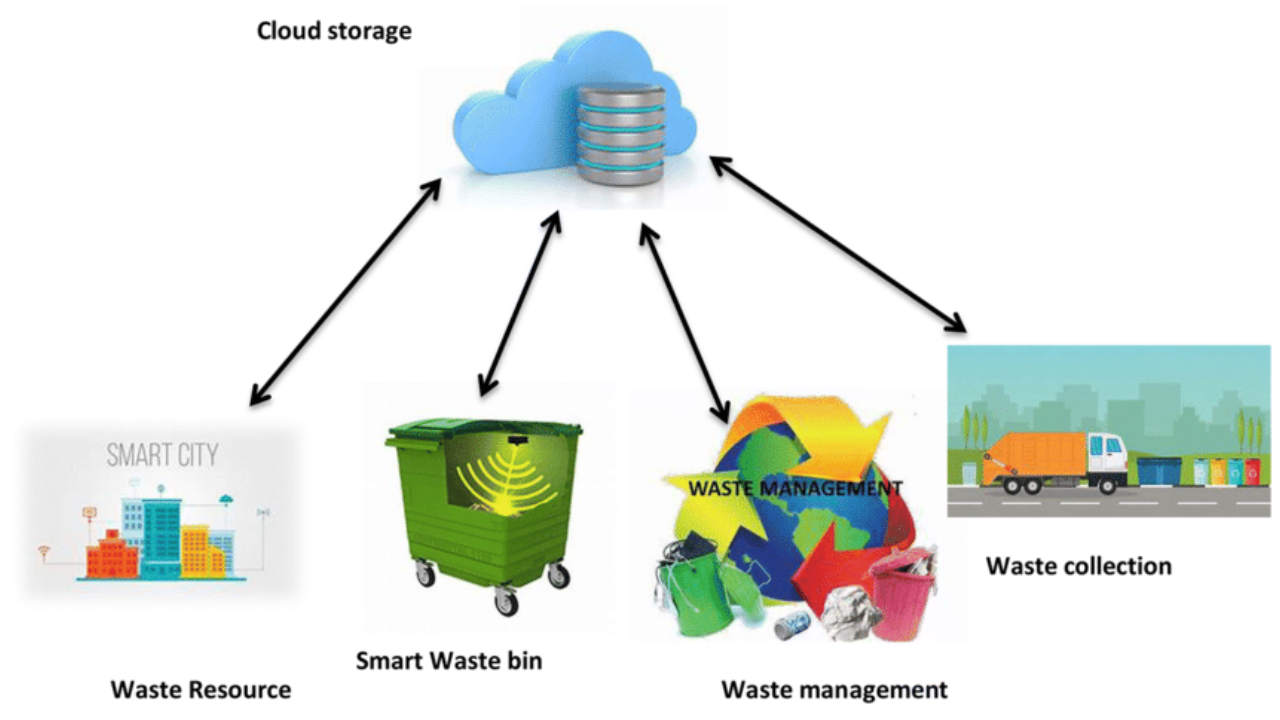

Waste Management: Investing in companies that focus on reducing waste, recycling, and developing innovative waste management solutions

As global consumption continues to rise, waste generation has become a pressing issue for our planet. Waste management is a crucial aspect of the sustainability agenda, and investing in companies that prioritize waste reduction, recycling, and innovative waste management solutions can yield both financial returns and environmental benefits.

Waste management companies that prioritize sustainability are poised for growth, as they offer solutions to the ever-growing problem of waste management. By investing in these companies, investors can not only contribute to a more sustainable future but also potentially profit from the growth of this emerging sector.

Reducing Waste: The First Step

The first step in waste management is reducing the amount of waste we generate. This can be achieved through conscious consumption and the adoption of circular economy principles. Companies that prioritize waste reduction can offer promising investment opportunities, as they promote sustainable production and consumption patterns.

Recycling: The Second Step

Recycling is another critical aspect of waste management. By recycling, we reduce the amount of waste that ends up in landfills, conserve natural resources, and reduce greenhouse gas emissions. Investing in recycling companies can be an excellent way to support this sustainable practice while potentially gaining financial returns.

Innovative Waste Management Solutions: The Third Step

Innovative waste management solutions, such as waste-to-energy technologies and biodegradable materials, are emerging as game-changers in the waste management industry. Companies that focus on developing such solutions can offer investors opportunities for high returns, as well as contribute to a greener future.

Investing in Waste Management Companies: The Benefits

Investing in companies that prioritize waste reduction, recycling, and innovative waste management solutions can offer numerous benefits, such as:

- Financial returns: Waste management companies that prioritize sustainability can offer promising investment opportunities, as they are poised for growth due to the ever-growing demand for sustainable waste management solutions.

- Positive environmental impact: By investing in sustainable waste management companies, investors can contribute to a more sustainable future, helping to reduce waste, conserve natural resources, and mitigate greenhouse gas emissions.

- Social responsibility: Investing in sustainable waste management companies demonstrates a commitment to social responsibility, as it contributes to a healthier planet and a better future for generations to come.

Environmental Services: Investing in companies that provide environmental consulting, engineering, and other services to promote sustainable practices

Protecting the environment is no longer a choice, it is a necessity. The rise of global warming, pollution, and climate change has sparked a surge in demand for environmental services. These services range from environmental consulting, engineering, and other innovative solutions that promote sustainable practices. With the world now taking a more proactive approach towards environmental protection, investing in companies that provide these services is not only an ethical choice but also a smart financial move.

The Need for Environmental Services

Environmental services are crucial in addressing environmental concerns and providing solutions that promote sustainability. These services are designed to help businesses, governments, and individuals adopt sustainable practices that protect the environment. The need for these services has increased due to the growing global population and the impact of industrialization on the environment. The demand for clean energy, water conservation, and sustainable waste management has led to the development of innovative environmental services that promote environmental sustainability.

The Benefits of Investing in Environmental Services

Investing in environmental services is not only a socially responsible decision but also a financially savvy one. The rise in environmental awareness has created a growing market for these services. The companies that provide environmental services are at the forefront of innovation and are well positioned to benefit from the increasing demand for sustainable solutions. By investing in these companies, investors can not only make a positive impact on the environment but also benefit financially from the growth potential of this market.

Top Companies in the Environmental Services Industry

- Tetra Tech Inc.

Tetra Tech is a leading provider of consulting, engineering, and technical services in the environmental and infrastructure markets. The company has over 20,000 employees worldwide and has been recognized as one of the world’s most ethical companies by Ethisphere for six consecutive years.

- AECOM

AECOM is a global infrastructure firm that provides design, consulting, engineering, and management services. The company has a strong focus on sustainability and has been recognized for its commitment to environmental stewardship.

- Golder Associates

Golder Associates is an employee-owned, global company that provides consulting, design, and construction services in the areas of earth, environment, and energy. The company has been recognized for its sustainability practices and commitment to environmental protection.

- Jacobs Engineering Group

Jacobs Engineering Group is a global provider of technical, professional, and construction services. The company has a strong focus on sustainability and has been recognized for its environmental practices.

Sustainable Investing Funds: Investing in funds that specialize in sustainable investing

Sustainable investing funds, also known as socially responsible investing (SRI) funds, are investment vehicles that aim to generate financial returns while also making a positive social and environmental impact. These funds invest in companies that have strong environmental, social, and governance (ESG) practices and seek to promote sustainable business practices. This means that these funds avoid investing in companies that engage in activities that are harmful to the environment, such as fossil fuel extraction or deforestation, and also consider the social and ethical implications of their investments.

Benefits of Sustainable Investing Funds

- Aligning Your Investments with Your Values

By investing in sustainable investing funds, you can align your investments with your personal values and beliefs. You can support companies that are committed to sustainability and contribute to positive change in the world.

- Positive Impact on the Environment and Society

Sustainable investing funds invest in companies that prioritize sustainable practices, such as reducing their carbon footprint, conserving natural resources, and promoting social justice. By investing in these funds, you can contribute to a more sustainable future and support companies that make a positive impact on society.

- Strong Financial Returns

Investing in sustainable investing funds does not mean sacrificing financial returns. In fact, many sustainable investing funds have performed as well as, or even better than, traditional investment funds. This is because companies with strong ESG practices are often better positioned to manage risks and capitalize on opportunities.

How to Invest in Sustainable Investing Funds

- Do Your Research

Research is key when it comes to investing in sustainable investing funds. Look for funds that align with your values and have a strong track record of performance.

- Consider the Fund’s Objectives and Investment Strategy

Before investing, it’s important to understand the fund’s investment objectives and strategy. Look for funds that have a clear focus on sustainable investing and prioritize companies with strong ESG practices.

- Diversify Your Portfolio

Diversification is important in any investment portfolio, including sustainable investing funds. Consider investing in a mix of funds that target different sectors and geographies to reduce risk and increase the potential for returns.

Socially Responsible Investing: Investing in companies that prioritize social responsibility and ethical business practices

Socially responsible investing, also known as sustainable investing or ethical investing, is the practice of investing in companies that prioritize social responsibility and ethical business practices. SRI investors consider factors such as environmental impact, human rights, and corporate governance when making investment decisions.

SRI investors believe that their investments can have a positive impact on the world, and that they can use their financial power to encourage companies to be more socially responsible.

Why Invest in Socially Responsible Companies?

Investing in socially responsible companies can provide a number of benefits, both for investors and for society as a whole.

- Financial Performance: Studies have shown that socially responsible companies can perform just as well, if not better, than their non-socially responsible counterparts. In fact, companies that prioritize sustainability and social responsibility may be more likely to succeed in the long term, as they are better equipped to deal with risks such as climate change and social unrest.

- Positive Impact: By investing in socially responsible companies, investors can support businesses that are making a positive impact on society and the environment. This can include companies that are working to reduce their carbon footprint, promote diversity and inclusion, or support human rights.

- Influence: As a shareholder in a company, investors have a say in how the company is run. By investing in socially responsible companies, investors can use their influence to encourage these companies to be more socially responsible and to make a positive impact on the world.

How to Invest in Socially Responsible Companies?

Investors interested in socially responsible investing have a number of options available to them. Some of these include:

- Socially Responsible Mutual Funds: Mutual funds are a popular investment vehicle that allow investors to pool their money together to invest in a diversified portfolio of stocks and other securities. Socially responsible mutual funds are managed by investment professionals who consider social responsibility factors when making investment decisions.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds, but they trade like stocks on an exchange. Socially responsible ETFs are designed to track an index of socially responsible companies.

- Individual Stocks: Investors can also choose to invest in individual stocks of socially responsible companies. This requires more research and due diligence, but can allow investors to have more control over their investments.

Green Bonds: Investing in bonds issued to finance environmentally friendly projects

Green bonds are fixed-income securities that are issued to fund environmentally friendly projects, such as renewable energy infrastructure, energy-efficient buildings, and sustainable agriculture. These bonds offer investors the opportunity to make a positive impact on the environment while earning a financial return.

Why invest in green bonds

There are several reasons why investors should consider adding green bonds to their portfolios:

- Aligning with values: Investing in green bonds allows individuals and institutions to support projects that align with their values and contribute to a more sustainable future.

- Diversification: Including green bonds in a portfolio can provide diversification benefits and reduce overall risk.

- Competitive returns: Green bonds typically offer competitive returns relative to other fixed-income investments.

- Positive impact: By investing in green bonds, investors can have a positive impact on the environment and society, helping to create a more sustainable world for future generations.

How do green bonds work

Green bonds work in much the same way as traditional bonds, but with a focus on funding environmentally friendly projects. Investors purchase the bonds, providing the issuer with capital to finance the project. The issuer then pays interest on the bond to the investor, typically on a semi-annual basis. When the bond matures, the investor receives the principal back.

What are the risks

As with any investment, there are risks associated with green bonds. These include:

- Interest rate risk: Changes in interest rates can impact the value of the bond.

- Credit risk: The issuer may default on the bond, resulting in a loss of principal.

- Liquidity risk: Green bonds may not be as liquid as other investments, making it difficult to sell them quickly.

- Project risk: The success of the project being funded by the bond may be uncertain, impacting the issuer’s ability to pay interest and repay the principal.

Impact Investing: Investing in companies and organizations that have a positive social and environmental impact while also generating a financial return

Impact investing matters because it enables investors to put their money where their values are. By investing in companies and organizations that align with their personal beliefs and goals, investors can make a positive impact on the world while also achieving financial success. Impact investing also helps to create a more sustainable and equitable future by directing capital towards businesses that are making a positive difference in society.

Types of Impact Investments

There are several types of impact investments that investors can consider, including:

- Environmental: Investments that focus on environmental issues, such as renewable energy, sustainable agriculture, and clean water.

- Social: Investments that focus on social issues, such as affordable housing, healthcare, and education.

- Governance: Investments that focus on good governance, such as transparency, accountability, and anti-corruption measures.

- Community Development: Investments that focus on building resilient communities, such as affordable housing, job creation, and small business development.

Benefits of Impact Investing

Impact investing offers a range of benefits for investors, including:

- Financial Returns: Impact investments can generate competitive financial returns while also providing social and environmental benefits.

- Social Impact: Impact investments enable investors to make a positive impact on society by directing capital towards businesses that are addressing social and environmental challenges.

- Risk Mitigation: Impact investments can help to mitigate risk by investing in businesses that are aligned with long-term sustainability and resilience.

- Innovation: Impact investing can spur innovation by directing capital towards businesses that are developing new solutions to social and environmental challenges.

Challenges of Impact Investing

While impact investing offers many benefits, there are also several challenges to consider, including:

- Measuring Impact: Measuring the social and environmental impact of investments can be difficult and complex.

- Financial Performance: Impact investments may not always generate the same level of financial returns as traditional investments.

- Lack of Standardization: There is a lack of standardization in the impact investing industry, which can make it difficult for investors to assess the impact of their investments.

Sustainable Forestry: Investing in companies that practice sustainable forestry practices and promote conservation

Investing in sustainable forestry is a sound financial decision that aligns with ecological and ethical consciousness. Here are some reasons why:

- Environmental Benefits: Sustainable forestry ensures that forests are managed in a way that preserves biodiversity, reduces carbon emissions, and maintains healthy ecosystems. This benefits the environment, the economy, and society as a whole.

- Economic Benefits: Investing in sustainable forestry can provide long-term financial benefits by ensuring a stable supply of timber and other forest products. Sustainable forestry practices can also create new markets for eco-friendly products, generating revenue and stimulating job growth.

- Social Benefits: Sustainable forestry practices are often designed to benefit local communities by creating jobs, improving infrastructure, and protecting traditional land rights. Investing in these practices supports social development and helps to promote environmental justice.

How to Invest in Sustainable Forestry

Investing in sustainable forestry requires a commitment to ethical and ecological consciousness. Here are some tips for investing in sustainable forestry:

- Research Companies: Before investing in any forestry company, research their sustainability practices and policies. Look for companies that prioritize conservation, biodiversity, and social responsibility.

- Look for Certifications: Many forestry companies have earned certifications from organizations like the Forest Stewardship Council (FSC) or the Programme for the Endorsement of Forest Certification (PEFC). These certifications ensure that the company is following sustainable forestry practices.

- Consider Mutual Funds: Mutual funds that specialize in sustainable forestry investments can be a good option for those who want to invest in this sector but lack the expertise to do so on their own. Look for funds that prioritize environmental and social sustainability.

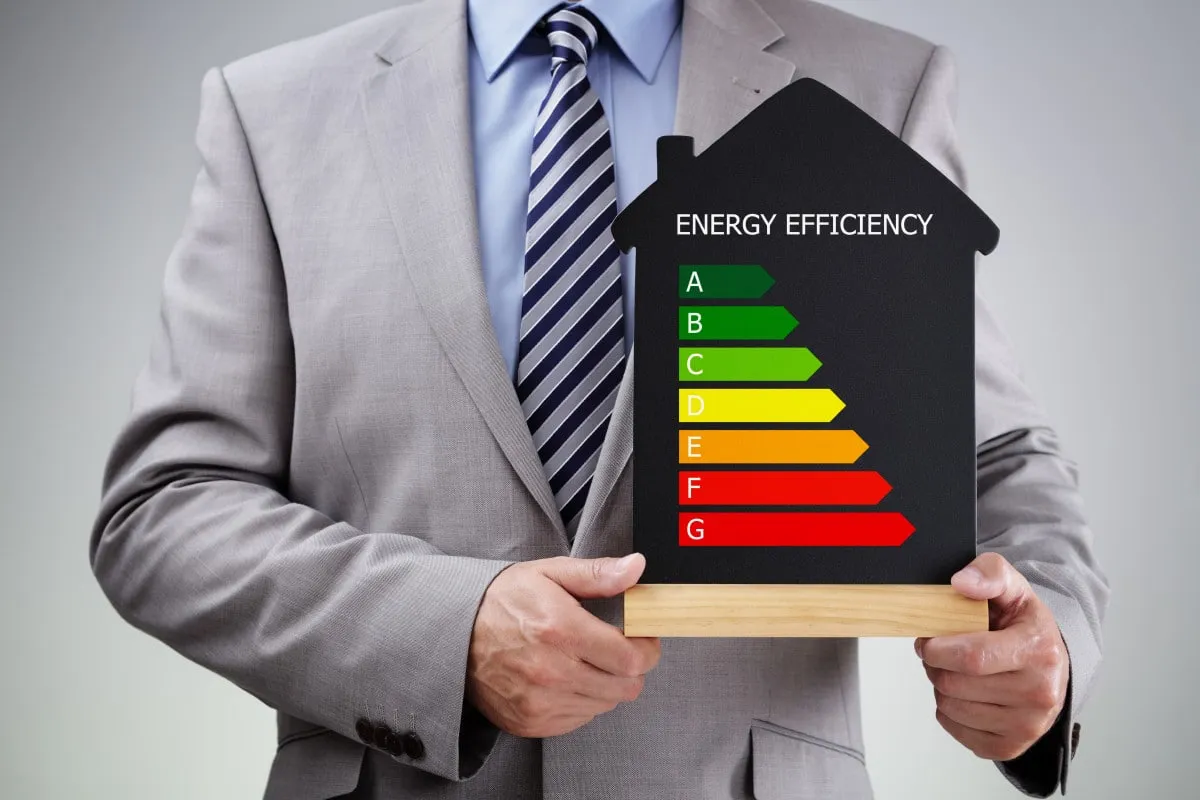

Energy Efficiency: Investing in companies that focus on energy efficiency solutions, such as smart home technology and energy-efficient appliances

Smart home technology is the use of interconnected devices and appliances that can be controlled remotely via a smartphone app or voice commands. These devices, which include smart thermostats, lighting systems, and security cameras, offer several benefits for both homeowners and investors alike:

- Cost savings: Smart home technology can help reduce energy consumption, which translates to lower electricity bills for homeowners. By optimizing energy usage, smart thermostats can save homeowners up to 10% on their heating and cooling costs.

- Convenience: Smart home technology offers homeowners the ability to control their home appliances and devices remotely, even while away from home. This can include turning lights on and off, adjusting the temperature, or even locking doors.

- Improved safety and security: Smart home technology can also improve safety and security by monitoring home security cameras and alerting homeowners of any suspicious activity.

The Benefits of Energy-Efficient Appliances

Energy-efficient appliances, which are designed to use less energy than traditional appliances, can help reduce a home’s energy consumption significantly. These appliances include refrigerators, washing machines, and dishwashers, among others, and offer several advantages:

- Cost savings: Energy-efficient appliances use less energy, which translates to lower electricity bills for homeowners. These savings can add up over time and lead to substantial cost reductions.

- Reduced environmental impact: Energy-efficient appliances help reduce greenhouse gas emissions and reduce the overall carbon footprint of a home. By investing in energy-efficient appliances, homeowners can make a significant contribution to environmental protection.

- Improved appliance lifespan: Energy-efficient appliances are designed to last longer than traditional appliances, resulting in fewer replacements and maintenance costs for homeowners.

Investing in Energy Efficiency: A Profitable Opportunity

Investing in companies that focus on energy efficiency solutions, such as smart home technology and energy-efficient appliances, can offer a compelling opportunity for investors. These companies are well-positioned to benefit from the increasing demand for energy-efficient products and services and offer several advantages, including:

- Growing market: The energy efficiency market is rapidly expanding, with the global smart home market expected to grow to $135 billion by 2025.

- High growth potential: Energy efficiency companies have high growth potential, with many experiencing rapid revenue growth and increased profitability.

- Positive social impact: By investing in energy efficiency companies, investors can make a positive impact on the environment and contribute to sustainable development.

Sustainable Packaging: Investing in companies that develop innovative and sustainable packaging solutions

Sustainable packaging companies are focused on developing products that reduce waste and minimize carbon footprints. This means looking at every aspect of the packaging process, from the materials used to the manufacturing and transportation processes.

Innovative Solutions

Companies developing sustainable packaging solutions are pushing the boundaries of what’s possible. From edible packaging made from seaweed to biodegradable packaging made from mushrooms, there are a wide range of innovative solutions being developed.

Growing Demand

Consumer demand for sustainable packaging is on the rise. According to a survey by Accenture, 83% of consumers believe it’s important for companies to design environmentally sustainable products. This means there is a growing market for sustainable packaging solutions, making it a smart investment opportunity.

Examples of Companies Developing Sustainable Packaging Solutions

- Loop Industries Inc. – This company is focused on reducing plastic waste by using technology to recycle PET plastic.

- Ecovative Design – Ecovative Design is developing biodegradable packaging made from mushrooms.

- Evoware – This company is developing edible packaging made from seaweed.

Investing in sustainable packaging companies is not only good for the planet but can also be a smart financial move. With a growing demand for sustainable solutions, these companies are poised for growth and innovation.

Sustainable packaging refers to materials and design solutions that reduce the environmental impact of packaging. These solutions aim to minimize waste, reduce carbon footprint, and ensure that packaging materials are recyclable, biodegradable, and compostable. The demand for sustainable packaging has been growing rapidly in recent years. According to a report by Grand View Research, the global sustainable packaging market is expected to reach $430.7 billion by 2025.

Investing in Sustainable Packaging Solutions: A Smart Business Decision

Investing in companies that develop sustainable packaging solutions is not only beneficial for the environment but also a smart business decision. Companies that embrace sustainable packaging can create a competitive edge by appealing to consumers who are environmentally conscious. Sustainable packaging solutions can also reduce costs associated with waste management and disposal, and in turn, improve a company’s bottom line.

Innovative Companies to Watch

There are several innovative companies that are leading the way in sustainable packaging solutions. These companies have developed new materials and design solutions that can significantly reduce the environmental impact of packaging.

- Loop Industries: Loop Industries is a technology company that has developed a method for upcycling waste plastic into high-quality food-grade packaging. The company’s technology can transform low-value plastic waste into high-value packaging materials.

- Ecovative Design: Ecovative Design is a company that has developed a range of sustainable packaging solutions made from natural materials. The company’s packaging solutions are biodegradable, compostable, and can replace traditional plastic packaging.

- Sulapac: Sulapac is a Finnish company that has developed a range of packaging solutions made from sustainable and renewable materials. The company’s packaging is fully biodegradable and can be composted in home composting systems.

- Evoware: Evoware is an Indonesian company that has developed a range of seaweed-based packaging solutions. The company’s packaging is edible, biodegradable, and can replace single-use plastic packaging.

Sustainable Tourism: Investing in companies that prioritize sustainable tourism practices, such as reducing waste and promoting conservation

Sustainable tourism practices can benefit not only the environment but also the local communities and the economy. By reducing waste and conserving natural resources, these companies contribute to the preservation of ecosystems, protecting the unique wildlife and landscapes that attract tourists. They also support local communities by creating job opportunities and promoting cultural preservation.

Investing in Sustainable Tourism Companies

Investing in sustainable tourism companies not only aligns with your personal values but also presents a sound financial opportunity. Companies that prioritize sustainability are more likely to attract conscious consumers, resulting in higher revenue and profitability in the long run. Furthermore, these companies often have a lower risk of regulatory intervention and reputation damage, which can ultimately impact their financial performance.

Criteria for Choosing Sustainable Tourism Companies

When considering which companies to invest in, it’s essential to evaluate their sustainability practices. Here are some criteria to look for:

- Waste Reduction: Companies that implement waste reduction strategies, such as minimizing single-use plastics, are more likely to have a lower impact on the environment.

- Conservation: Companies that prioritize conservation efforts, such as supporting wildlife conservation or promoting sustainable agriculture, demonstrate their commitment to preserving natural resources.

- Community Support: Companies that support the local communities through job creation and cultural preservation are more likely to have a positive impact on the economy and social well-being.

Examples of Sustainable Tourism Companies

Several companies have made a commitment to sustainable tourism practices, making them ideal candidates for investment. Some examples include:

- G Adventures: A travel company that offers sustainable tours and promotes responsible tourism practices.

- Airbnb: A platform that promotes eco-friendly accommodations and supports sustainable tourism initiatives.

- Patagonia: An outdoor clothing and gear company that invests in conservation efforts and advocates for environmental protection.

Investing in sustainable tourism companies not only benefits the environment but also presents a promising financial opportunity. By evaluating companies’ sustainability practices and choosing those that prioritize waste reduction, conservation, and community support, you can make a positive impact while also potentially achieving financial returns.

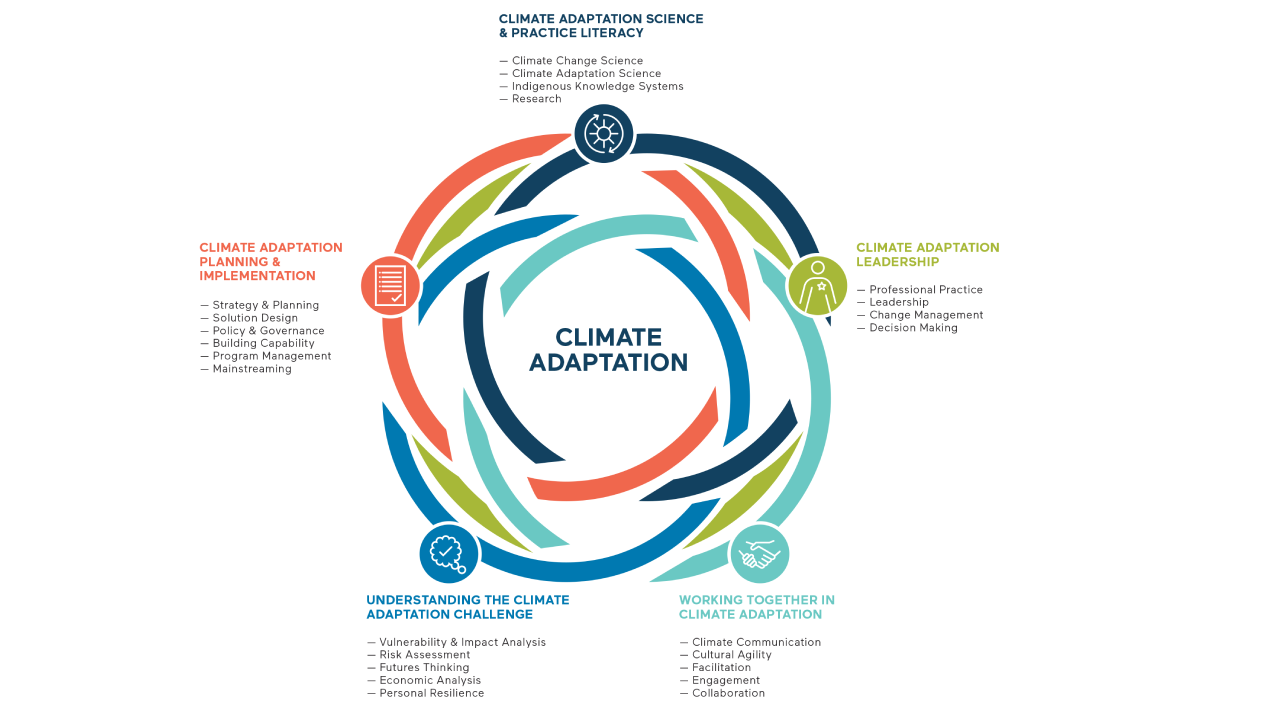

Climate Adaptation: Investing in companies that develop solutions to adapt to the effects of climate change, such as rising sea levels and extreme weather events

The reality of climate change is undeniable. The world is experiencing rising sea levels, droughts, extreme weather events, and other environmental challenges. As a result, climate adaptation has become a pressing need. One of the most effective ways to address this need is by investing in companies that develop solutions to adapt to the effects of climate change.

In this article, we explore the importance of climate adaptation and highlight the benefits of investing in innovative companies that engineer resilience. We will also provide a few examples of companies that are leading the charge in this field.

The Importance of Climate Adaptation

Climate adaptation is the process of adjusting to the changing climate in order to reduce the vulnerability of people, infrastructure, and ecosystems. It involves developing strategies and solutions that can withstand the effects of climate change. The importance of climate adaptation cannot be overstated. Failure to adapt will result in catastrophic consequences, including loss of life, displacement of populations, and economic damage.

Benefits of Investing in Climate Adaptation

Investing in companies that develop solutions for climate adaptation has several benefits. First and foremost, it helps to mitigate the impact of climate change. Companies that engineer resilience are at the forefront of developing strategies and technologies that can help communities and businesses adapt to changing environmental conditions.

Secondly, investing in climate adaptation can be financially rewarding. The companies that develop innovative solutions for climate adaptation are likely to experience strong growth in demand for their products and services. This growth will translate into increased profitability and higher stock prices for investors.

Examples of Companies that are Engineering Resilience

Here are a few examples of companies that are leading the charge in developing solutions for climate adaptation:

- 4D Sight: This company uses artificial intelligence to predict and prevent flooding in urban areas. Their technology helps cities to prepare for floods by providing early warning systems and flood mapping.

- Ocean Power Technologies: This company develops wave energy converters that can generate electricity from the motion of ocean waves. This technology has the potential to provide a reliable source of renewable energy in areas that are vulnerable to power outages during extreme weather events.

- Arcadis: This company is a global leader in engineering and consulting services for infrastructure projects. Their expertise in designing resilient infrastructure can help communities to adapt to the effects of climate change.

Community Development: Investing in companies and organizations that focus on community development and social impact

As the world continues to evolve, individuals are becoming more conscious of their actions and their impact on society. With this consciousness comes a desire to support organizations and companies that prioritize community development and social impact. Investing in such organizations not only benefits society but also allows investors to make a positive impact while still achieving financial returns.

The following is a guide to investing in community development and socially responsible companies and organizations:

- Research Companies and Organizations

Before investing, research companies and organizations to ensure that they prioritize community development and social impact. This can be done by reviewing the organization’s mission statement, their past actions, and any public statements they have made regarding social responsibility.

- Consider Environmental, Social, and Governance (ESG) Factors

ESG factors are non-financial criteria that investors can use to evaluate the sustainability and ethical impact of an organization. These factors include environmental impact, social responsibility, and corporate governance. By considering these factors, investors can ensure that their investments align with their values and contribute to positive social change.

- Look for Impact Investing Opportunities

Impact investing is a form of investing that seeks to generate a social or environmental impact alongside a financial return. Impact investors prioritize organizations that have a positive impact on society and seek to make a measurable difference in the world. By investing in these organizations, investors can support community development while still achieving financial returns.

- Support Community Development Organizations

Community development organizations focus on creating positive change in underserved communities. By investing in these organizations, investors can support initiatives such as affordable housing, education, and job creation. These organizations often provide a direct and measurable impact on the community, allowing investors to see the change they are making.

- Consider Socially Responsible Funds

Socially responsible funds are investment vehicles that prioritize companies and organizations that have a positive impact on society. These funds often have strict criteria for investment, ensuring that their portfolio aligns with social and environmental values. Investing in socially responsible funds allows investors to diversify their investments while still supporting community development and social impact.

Corporate Social Responsibility: Investing in companies that prioritize social responsibility and ethical business practices, such as fair labor practices and environmental stewardship

Corporate Social Responsibility (CSR) refers to a company’s commitment to operating in an economically, socially, and environmentally sustainable manner. Companies that prioritize CSR focus on the long-term sustainability of their business practices and take into consideration the impact of their operations on the environment, society, and the economy. This commitment is not only beneficial for the environment and society, but it also contributes to the long-term success of the company.

The Benefits of Investing in Companies that Prioritize Social Responsibility

- Improved Brand Reputation: Companies that prioritize social responsibility have a positive brand reputation, which attracts socially conscious consumers and investors. This, in turn, can lead to increased revenue and profits for the company.

- Reduced Risk: Companies that prioritize social responsibility are less likely to face legal and regulatory issues related to unethical business practices. This can reduce the risk for investors and ensure long-term stability for the company.

- Increased Innovation: Companies that prioritize social responsibility are often more innovative, as they are committed to finding sustainable solutions to problems. This can lead to the development of new products and services that are more environmentally friendly and socially responsible.

- Attracting and Retaining Talent: Companies that prioritize social responsibility often attract and retain talented employees who share the same values. This can lead to a more motivated and productive workforce, which can ultimately lead to increased profits.